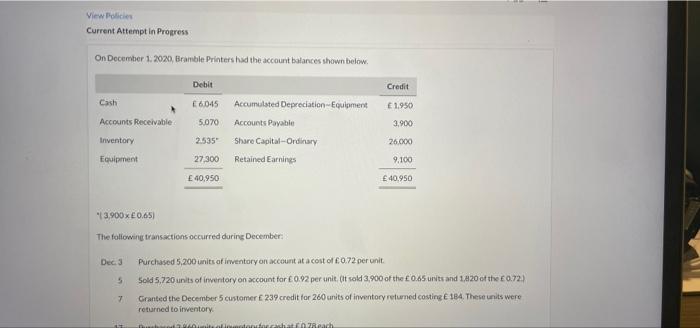

Question: View Policies Current Attempt in Progress On December 1, 2020, Bramble Printers had the account balances shown below. Debit Credit Cash 6045 1.950 Accumulated Depreciation

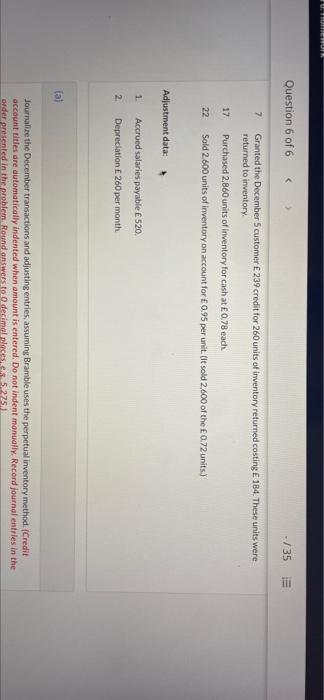

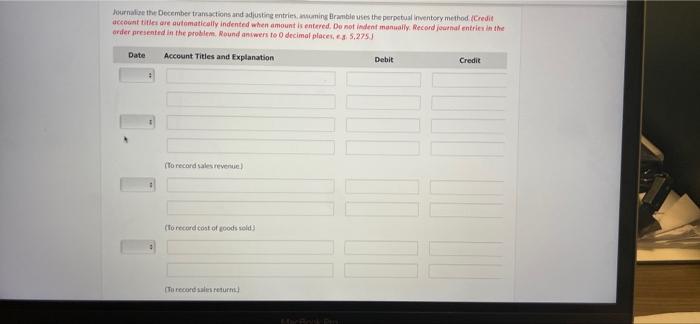

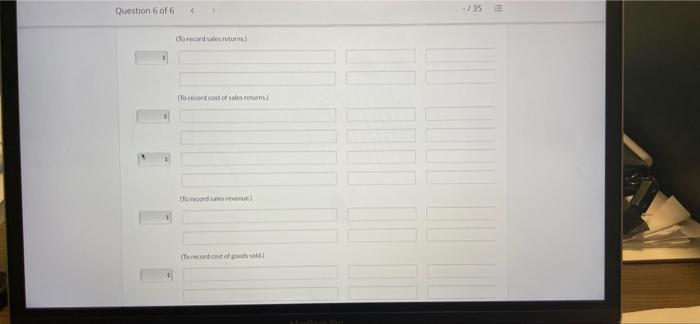

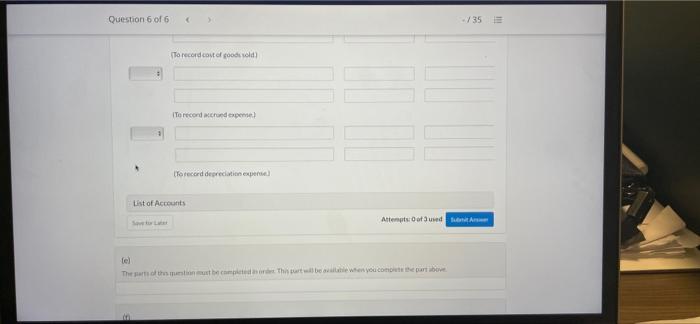

View Policies Current Attempt in Progress On December 1, 2020, Bramble Printers had the account balances shown below. Debit Credit Cash 6045 1.950 Accumulated Depreciation Equipment Accounts Payable Accounts Receivable 5.070 3.900 2.535 Inventory Equipment Share Capital-Ordinary Retained Earnings 26.000 9,100 27.300 40,950 40,950 3,900x0.65 The following transactions occurred during December Dec 3 5 Purchased 5,200 units of inventory on account at a cost of 0.72 per unit Sold 5,720 units of inventory on account for 0.92 per unit Olt sold 3,900 of the 0.65 units and 1,420 of the 0.72.) Granted the December 5 customer E239 credit for 260 units of inventory returned conting 184. These units were returned to inwentory 7 infrachatach UNTUR Question 6 of 6 -/35 Ti 7 Granted the December 5 customer 239 credit for 260 units of inventory returned costing E 184. These units were returned to inventory 17 Purchased 2,860 units of inventory for cash at 0.78 each 22 Sold 2.600 units of inventory on account for 0.95 per unit. (It sold 2.600 of the 0.72 units) Adjustment data: 1. Accrued salaries payable 520 2 Depreciation E 260 per month (a) Journalize the December transactions and adjusting entries, assuming Bramble uses the perpetual inventory method. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the oder presented in the problem Round answers to O decimal places 5.275 Journalist December transactions and adjusting entries suming bramble uses the perpetual inventory method Credit account titles are automatically indented when amount is entered. De not indent manually. Record journal entries in the onder presented in the problem. Round answers to decimal places, 5.275 Date Account Titles and Explanation Debit Credit (To record sales revenue (to record cost of goods sold To record sales return) Question 6 of 6 /35 (To record des ruum Tarecen cost of returns to recorder (record contacoods Question 6 of 6 > -735 E To record cost of goods sold To record de pe to record depreciation expense List of Accounts Attempts of used to lel The part of the most become that we are when you come art

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts