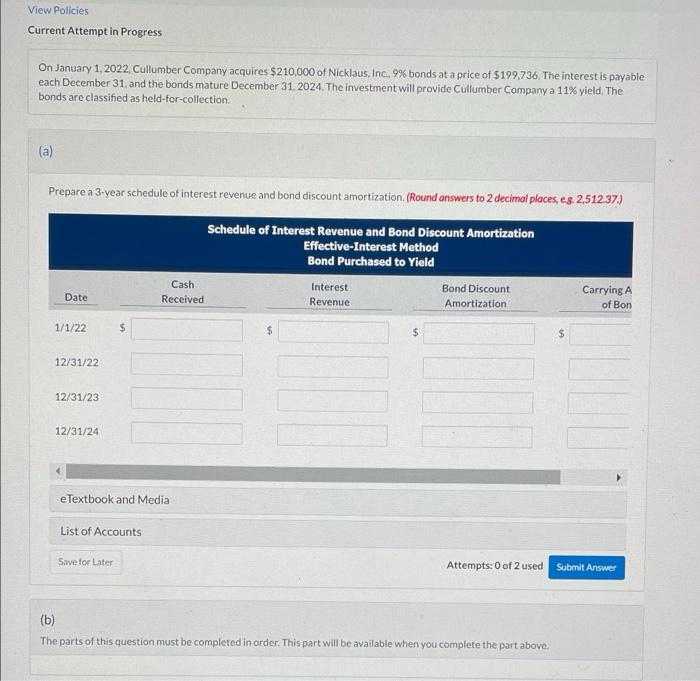

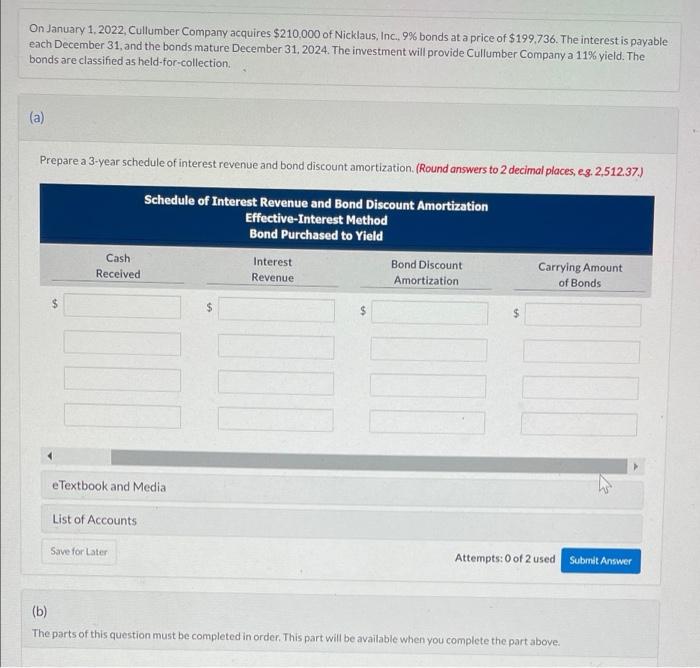

Question: View Policies Current Attempt in Progress On January 1, 2022, Cullumber Company acquires $210,000 of Nicklaus, Inc. 9% bonds at a price of $199,736. The

View Policies Current Attempt in Progress On January 1, 2022, Cullumber Company acquires $210,000 of Nicklaus, Inc. 9% bonds at a price of $199,736. The interest is payable each December 31, and the bonds mature December 31, 2024. The investment will provide Cullumber Company a 11% yield. The bonds are classified as held-for-collection (a) Prepare a 3-year schedule of interest revenue and bond discount amortization (Round answers to 2 decimal places, eg. 2,512.37.) Schedule of Interest Revenue and Bond Discount Amortization Effective-Interest Method Bond Purchased to Yield Date Cash Received Interest Revenue Bond Discount Amortization Carrying A of Bon 1/1/22 $ $ $ 12/31/22 12/31/23 12/31/24 e Textbook and Media List of Accounts Save for Later Attempts: 0 of 2 used Submit Answer (b) The parts of this question must be completed in order. This part will be available when you complete the part above. On January 1, 2022, Cullumber Company acquires $210,000 of Nicklaus, Inc., 9% bonds at a price of $199.736. The interest is payable each December 31, and the bonds mature December 31, 2024. The investment will provide Cullumber Company a 11% yield. The bonds are classified as held-for-collection (a) Prepare a 3-year schedule of interest revenue and bond discount amortization. (Round answers to 2 decimal places, eg. 2,512.37.) Schedule of Interest Revenue and Bond Discount Amortization Effective-Interest Method Bond Purchased to Yield Cash Interest Bond Discount Received Revenue Amortization Carrying Amount of Bonds $ $ $ $ e Textbook and Media List of Accounts Save for Later Attempts: 0 of 2 used Submit Answer (b) The parts of this question must be completed in order. This part will be available when you complete the part above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts