Question: View Policies Current Attempt in Progress On January 1 , year 1 , Frost Co . entered into a two - year lease agreement with

View Policies

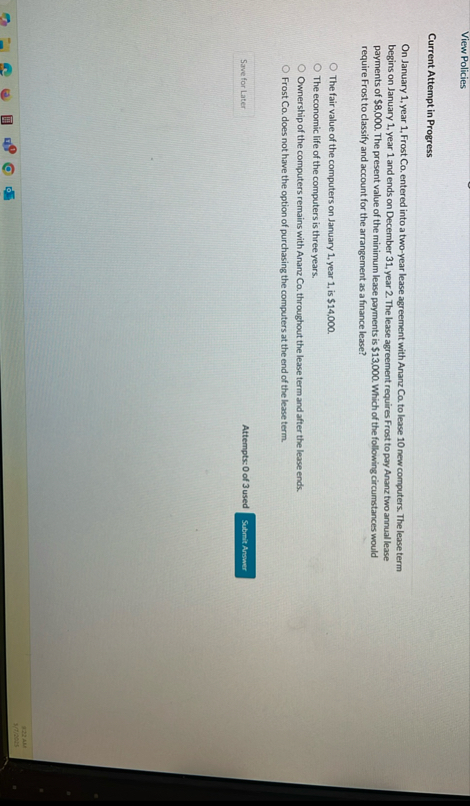

Current Attempt in Progress

On January year Frost Co entered into a twoyear lease agreement with Ananz Co to lease new computers. The lease term begins on January year and ends on December year The lease agreement requires Frost to pay Ananz two annual lease payments of $ The present value of the minimum lease payments is $ Which of the following circumstances would require Frost to classify and account for the arrangement as a finance lease?

The fair value of the computers on January year is $

The economic life of the computers is three years.

Ownership of the computers remains with Ananz Co throughout the lease term and after the lease ends.

Frost Co does not have the option of purchasing the computers at the end of the lease term.

Attempts: of used

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock