Question: View Policies Current Attempt in Progress On July 1, 2020, Molly's Greenhouse purchased a new delivery truck for $70,000. She paid a $20,000 cash

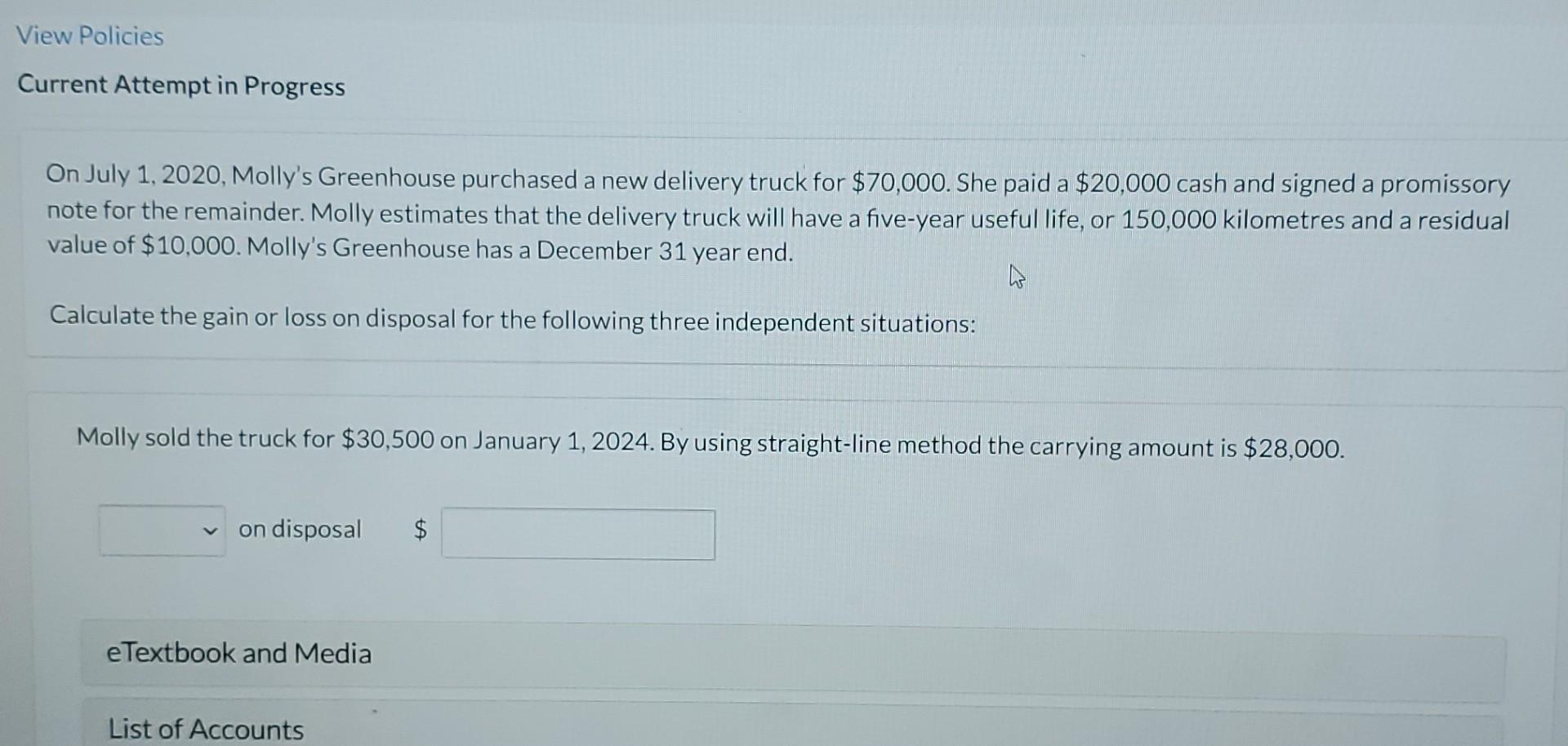

View Policies Current Attempt in Progress On July 1, 2020, Molly's Greenhouse purchased a new delivery truck for $70,000. She paid a $20,000 cash and signed a promissory note for the remainder. Molly estimates that the delivery truck will have a five-year useful life, or 150,000 kilometres and a residual value of $10,000. Molly's Greenhouse has a December 31 year end. Calculate the gain or loss on disposal for the following three independent situations: Molly sold the truck for $30,500 on January 1, 2024. By using straight-line method the carrying amount is $28,000. on disposal $ eTextbook and Media List of Accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts