Question: View Policies Current Attempt in Progress On July 31, Oriole Ltd. had a cash balance of $12,690 in its general ledger. The bank statement from

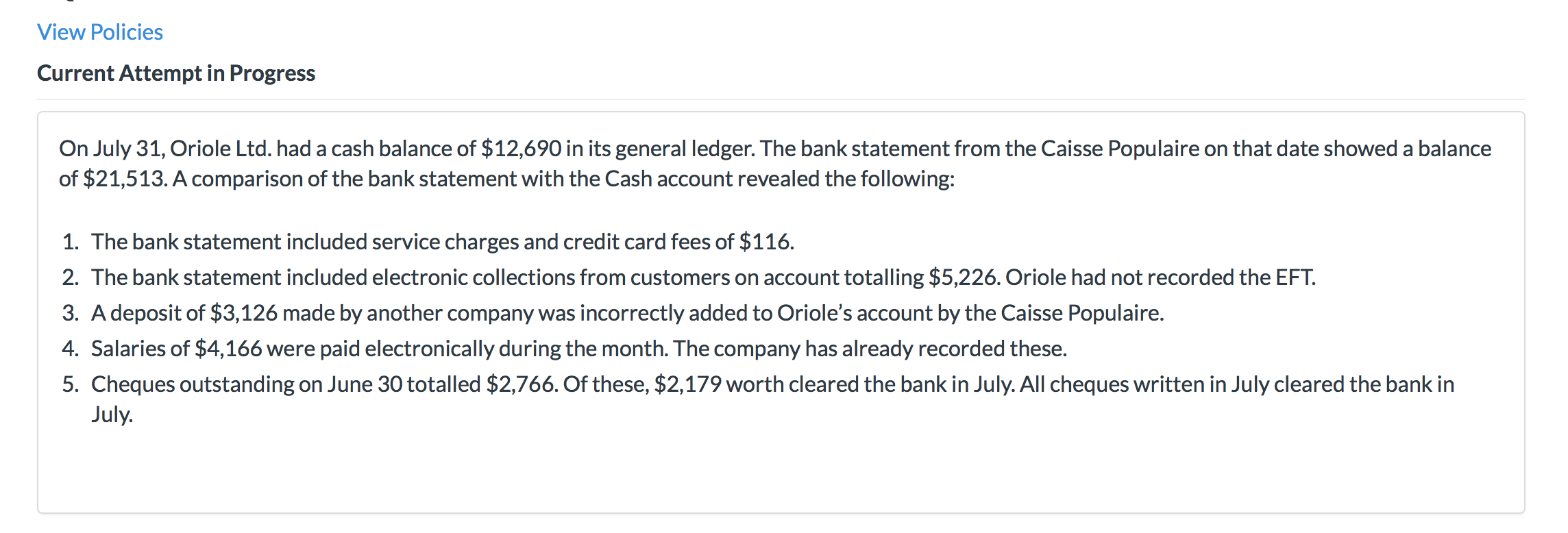

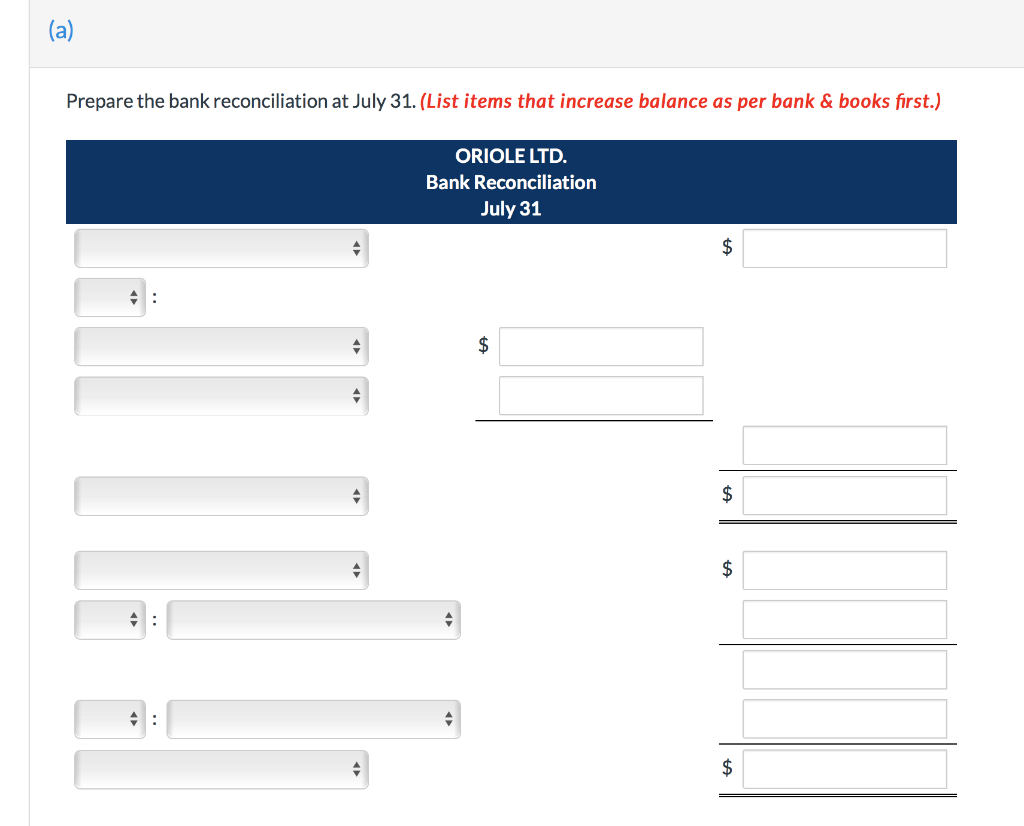

View Policies Current Attempt in Progress On July 31, Oriole Ltd. had a cash balance of $12,690 in its general ledger. The bank statement from the Caisse Populaire on that date showed a balance of $21,513. A comparison of the bank statement with the Cash account revealed the following: 1. The bank statement included service charges and credit card fees of $116. 2. The bank statement included electronic collections from customers on account totalling $5,226. Oriole had not recorded the EFT. 3. A deposit of $3,126 made by another company was incorrectly added to Oriole's account by the Caisse Populaire. 4. Salaries of $4,166 were paid electronically during the month. The company has already recorded these. 5. Cheques outstanding on June 30 totalled $2,766. Of these, $2,179 worth cleared the bank in July. All cheques written in July cleared the bank in July Prepare the bank reconciliation at July 31. (List items that increase balance as per bank & books first.) ORIOLE LTD. Bank Reconciliation July 31 ta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts