Question: View Policies Current Attempt in Progress On October 1, 2025, Wildhorse Equipment Company sold a pecan-harvesting machine to Valco Brothers Farm, Inc. In lieu

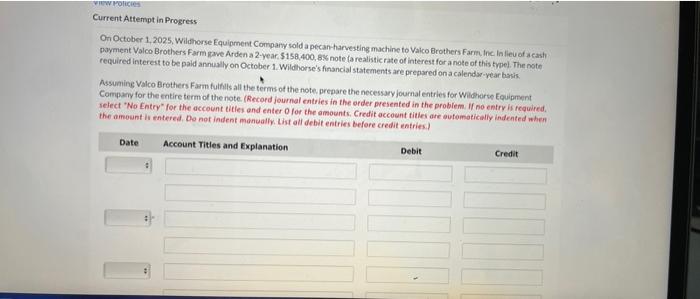

View Policies Current Attempt in Progress On October 1, 2025, Wildhorse Equipment Company sold a pecan-harvesting machine to Valco Brothers Farm, Inc. In lieu of a cash payment Valco Brothers Farm gave Arden a 2-year, $158,400,8% note (a realistic rate of interest for a note of this type). The note required interest to be paid annually on October 1. Wildhorse's financial statements are prepared on a calendar-year basis Assuming Valco Brothers Farm fulfills all the terms of the note, prepare the necessary journal entries for Wildhorse Equipment Company for the entire term of the note. (Record journal entries in the order presented in the problem. If no entry is required. select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries) Date Account Titles and Explanation Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts