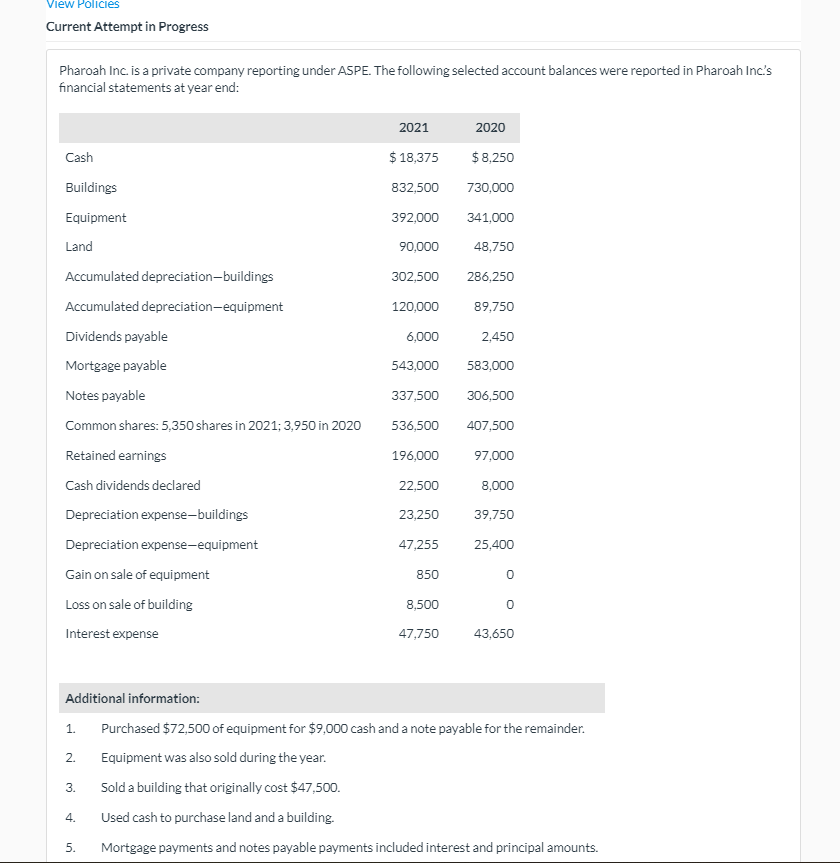

Question: View Policies Current Attempt in Progress Pharoah Inc. is a private company reporting under ASPE. The following selected account balances were reported in Pharoah Inc's

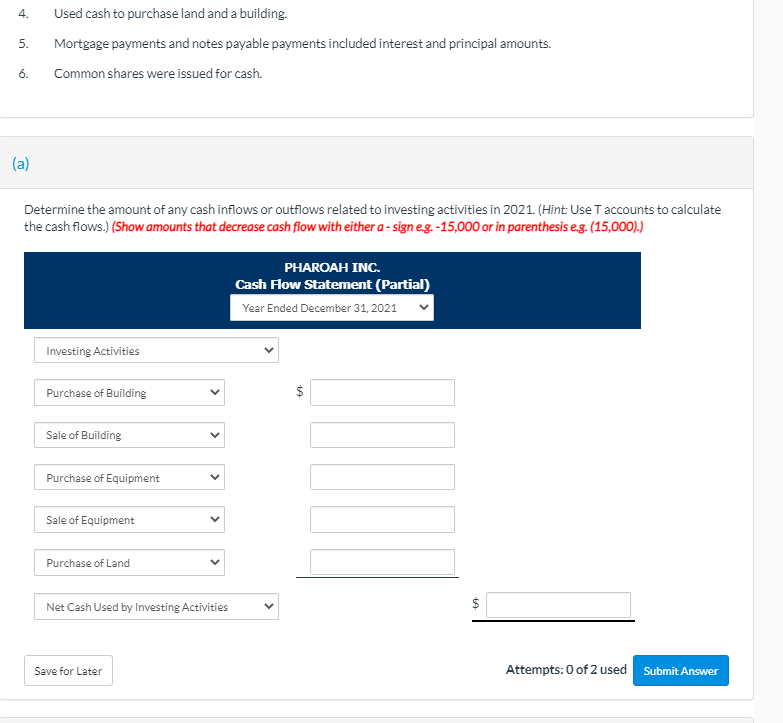

View Policies Current Attempt in Progress Pharoah Inc. is a private company reporting under ASPE. The following selected account balances were reported in Pharoah Inc's financial statements at year end: 2021 2020 Cash $ 8,250 $ 18,375 832,500 Buildings 730,000 Equipment 392,000 341.000 Land 90,000 48,750 Accumulated depreciation-buildings 302,500 286,250 120,000 89,750 6,000 2,450 543,000 583,000 337,500 306,500 536,500 407,500 196,000 97,000 Accumulated depreciation equipment Dividends payable Mortgage payable Notes payable Common shares: 5,350 shares in 2021; 3,950 in 2020 Retained earnings Cash dividends declared Depreciation expense-buildings Depreciation expense-equipment Gain on sale of equipment Loss on sale of building Interest expense 22,500 8,000 23,250 39,750 47,255 25,400 850 0 8,500 0 47,750 43,650 1. 2. 3. 4. . Additional information: Purchased $72,500 of equipment for $9,000 cash and a note payable for the remainder. Equipment was also sold during the year. Sold a building that originally cost $47,500. Used cash to purchase land and a building. Mortgage payments and notes payable payments included interest and principal amounts. 4. 5. Used cash to purchase land and a building. Mortgage payments and notes payable payments included interest and principal amounts. Common shares were issued for cash. 6. (a) Determine the amount of any cash inflows or outflows related to investing activities in 2021. (Hint: Use T accounts to calculate the cash flows.) (Show amounts that decrease cash flow with either a - signe.g.-15,000 or in parenthesis eg. (15,000).) PHAROAH INC. Cash Flow Statement (Partial) Year Ended December 31, 2021 Investing Activities Purchase of Building $ Sale of Building Purchase of Equipment Sale of Equipment Purchase of Land $ Net Cash Used by Investing Activities Save for Later Attempts: 0 of 2 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts