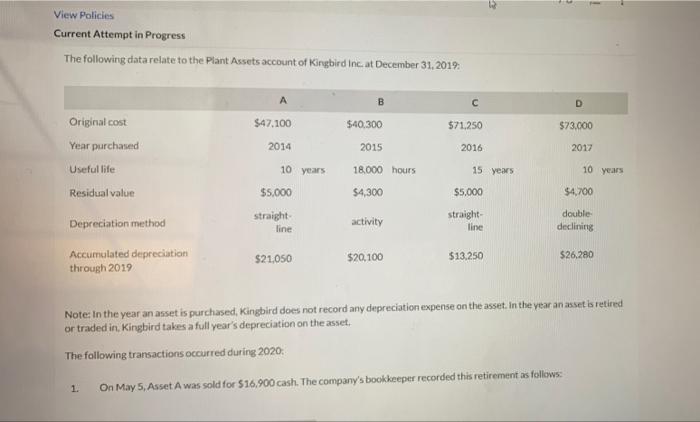

Question: View Policies Current Attempt in Progress The following data relate to the Plant Assets account of Kingbird Inc. at December 31, 2019 A B

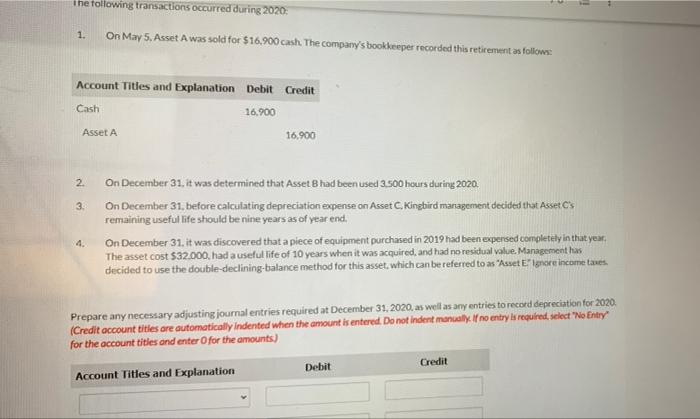

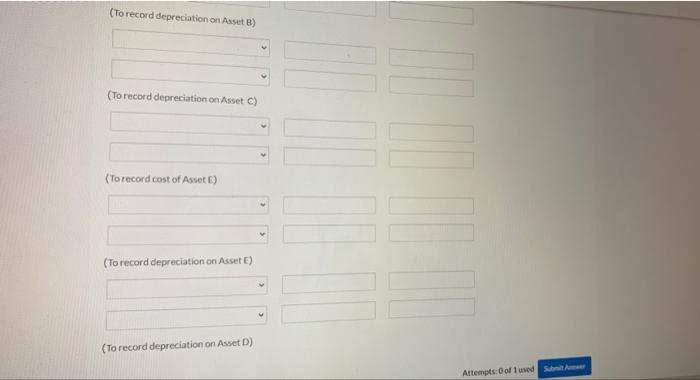

View Policies Current Attempt in Progress The following data relate to the Plant Assets account of Kingbird Inc. at December 31, 2019 A B C D Original cost Year purchased $47.100 $40,300 $71,250 $73,000 2014 2015 2016 2017 Useful life 10 years 18,000 hours 15 years 10 years Residual value $5,000 $4,300 $5,000 $4,700 straight- straight- double Depreciation method activity line line declining Accumulated depreciation $21,050 $20,100 $13,250 $26,280 through 2019 Note: In the year an asset is purchased, Kingbird does not record any depreciation expense on the asset. In the year an asset is retired or traded in, Kingbird takes a full year's depreciation on the asset. The following transactions occurred during 2020: 1. On May 5, Asset A was sold for $16,900 cash. The company's bookkeeper recorded this retirement as follows:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts