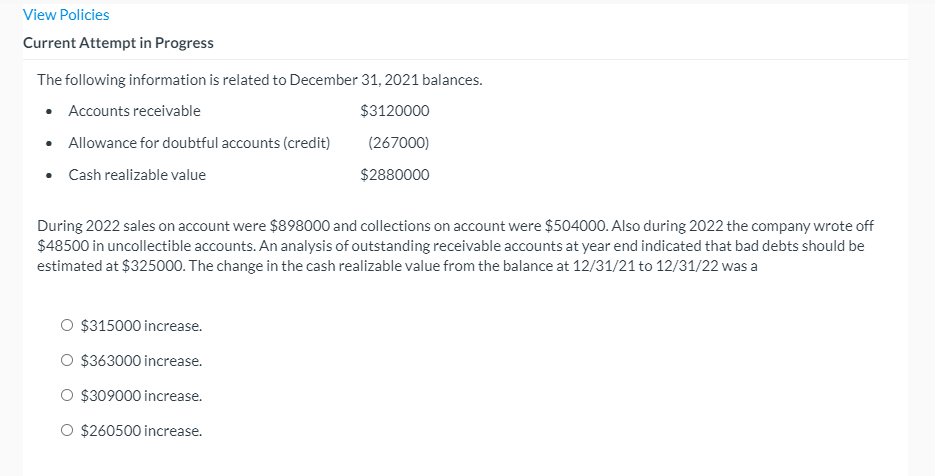

Question: View Policies Current Attempt in Progress The following information is related to December 31, 2021 balances. Accounts receivable $3120000 Allowance for doubtful accounts (credit) (267000)

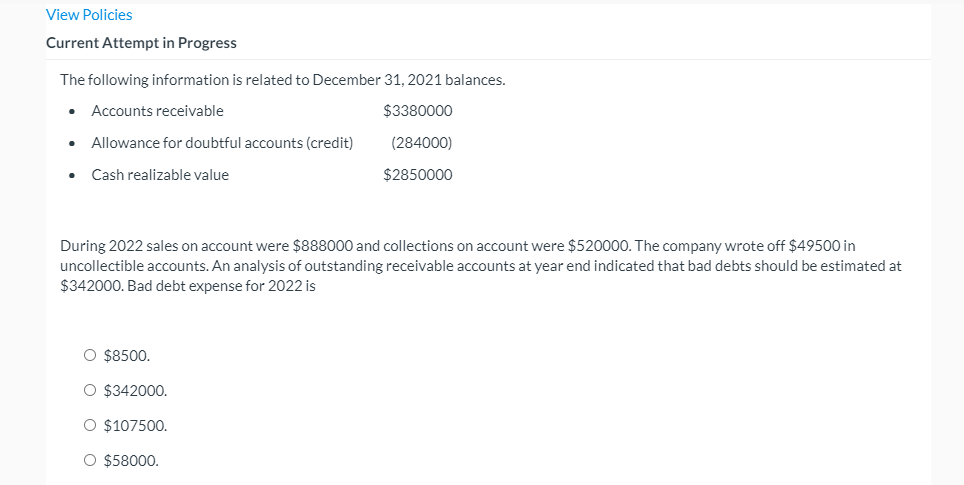

View Policies Current Attempt in Progress The following information is related to December 31, 2021 balances. Accounts receivable $3120000 Allowance for doubtful accounts (credit) (267000) Cash realizable value $2880000 During 2022 sales on account were $898000 and collections on account were $504000. Also during 2022 the company wrote off $48500 in uncollectible accounts. An analysis of outstanding receivable accounts at year end indicated that bad debts should be estimated at $325000. The change in the cash realizable value from the balance at 12/31/21 to 12/31/22 was a $315000 increase. O $363000 increase. O $309000 increase. O $260500 increase. View Policies Current Attempt in Progress The following information is related to December 31, 2021 balances. . Accounts receivable $3380000 . Allowance for doubtful accounts (credit) (284000) Cash realizable value $2850000 During 2022 sales on account were $888000 and collections on account were $520000. The company wrote off $49500 in uncollectible accounts. An analysis of outstanding receivable accounts at year end indicated that bad debts should be estimated at $342000. Bad debt expense for 2022 is O $8500. O $342000. O $107500. O $58000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts