Question: View Policies Current Attempt in Progress The pretax operating cash flow of Ivanhoe Motors declined so much during the recession of 2008 and 2009 that

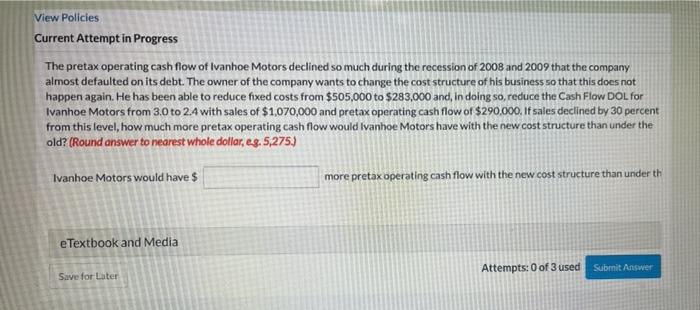

View Policies Current Attempt in Progress The pretax operating cash flow of Ivanhoe Motors declined so much during the recession of 2008 and 2009 that the company almost defaulted on its debt. The owner of the company wants to change the cost structure of his business so that this does not happen again. He has been able to reduce fixed costs from $505,000 to $283,000 and, in doing so, reduce the Cash Flow DOL for Ivanhoe Motors from 3.0 to 2.4 with sales of $1,070,000 and pretax operating cash flow of $290.000. If sales declined by 30 percent from this level, how much more pretax operating cash flow would Ivanhoe Motors have with the new cost structure than under the old? (Round answer to nearest whole dollar, eg. 5,275.) Ivanhoe Motors would have $ more pretax operating cash flow with the new cost structure than under th e Textbook and Media Attempts: 0 of 3 used Submit Answer Save for Liter

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts