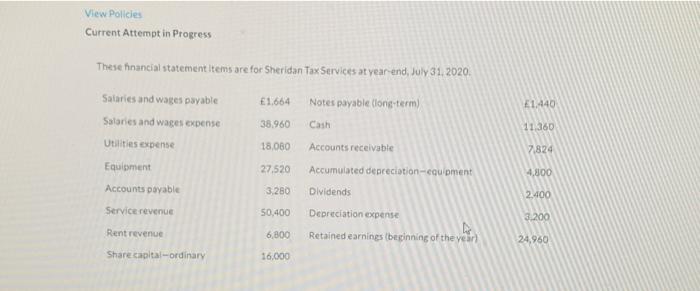

Question: View Policies Current Attempt in Progress These financial statement items are for Sheridan Tax Services at year-end, July 31, 2020 1.664 1.440 Notes payable long-term

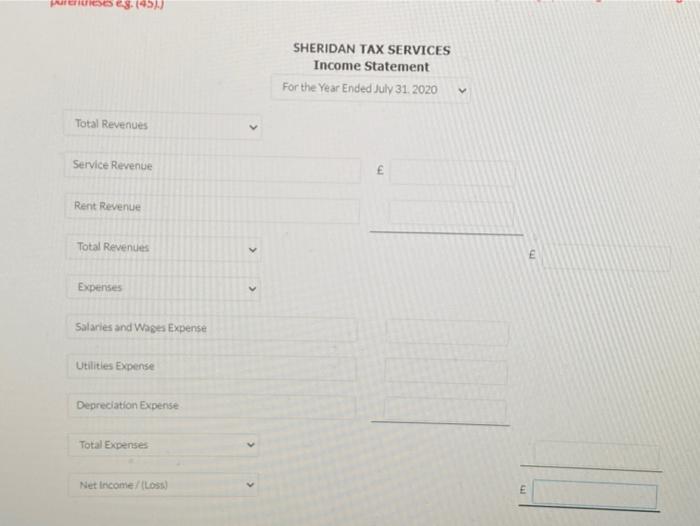

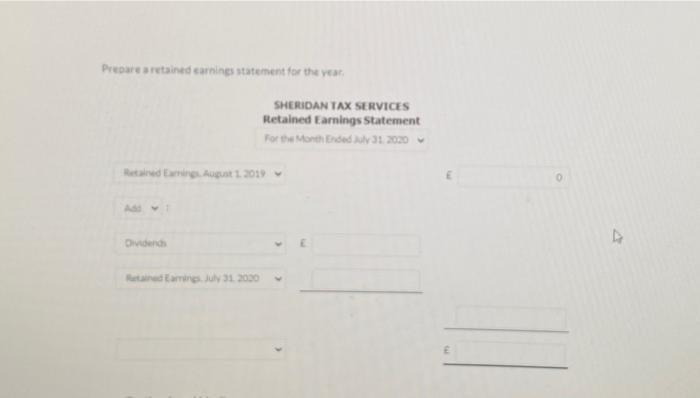

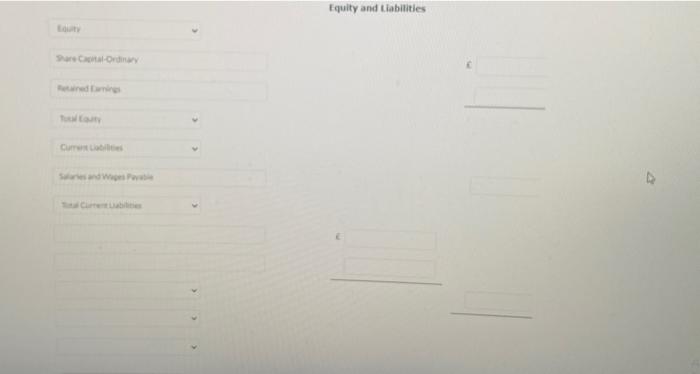

View Policies Current Attempt in Progress These financial statement items are for Sheridan Tax Services at year-end, July 31, 2020 1.664 1.440 Notes payable long-term Cash 38.960 11:360 Salaries and wages payable Sataries and wages expense Utilities expense Equipment 18.080 Accounts receivable 7.824 27.520 4,300 Accumulated depreciation-equipment Dividends Accounts payable 3.280 2.400 Service revenue 50.400 Depreciation expense 3.200 Rent revenue 6,800 Retained earnings beginning of the year 24,950 Share capital-ordinary 16.000 ETC eg. 19 SHERIDAN TAX SERVICES Income Statement For the Year Ended July 31, 2020 V Total Revenues Service Revenue E Rent Revenue Total Revenues Expenses Salaries and Wages Expense Utlitles Expense Depreciation Expense Total Expenses Net Income (Loss) E Prepare retained earnings statement for the year SHERIDAN TAX SERVICES Retained Earnings Statement For the Month Ended 31 2000 ered August 2019 0 D Cividando and Earnings. 312000 Equity and liabilities Share Capnal-ordinary Curs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts