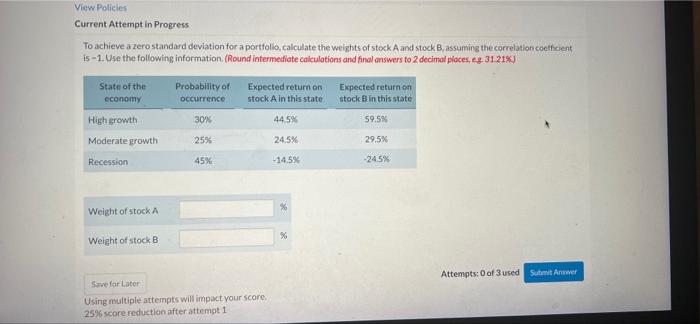

Question: View Policies Current Attempt in Progress To achieve a zero standard deviation for a portfolio, calculate the weights of stock A and stock B, assuming

View Policies Current Attempt in Progress To achieve a zero standard deviation for a portfolio, calculate the weights of stock A and stock B, assuming the correlation coefficient is-1. Use the following information (Round intermediate calculations and final answers to 2 decimal places, eg. 3121%) Probability of occurrence State of the economy High growth Moderate growth Expected return on stock A in this state 44.5% Expected return on stock B in this state 30% 59.5% 25% 24.5% 29.5% Recession 45% -14.5% -24.5% % Weight of stock A %6 Weight of stock B Attempts: 0 of 3 used Suteit Antwer Save for Later Using multiple attempts will impact your score. 25% score reduction after attempt 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts