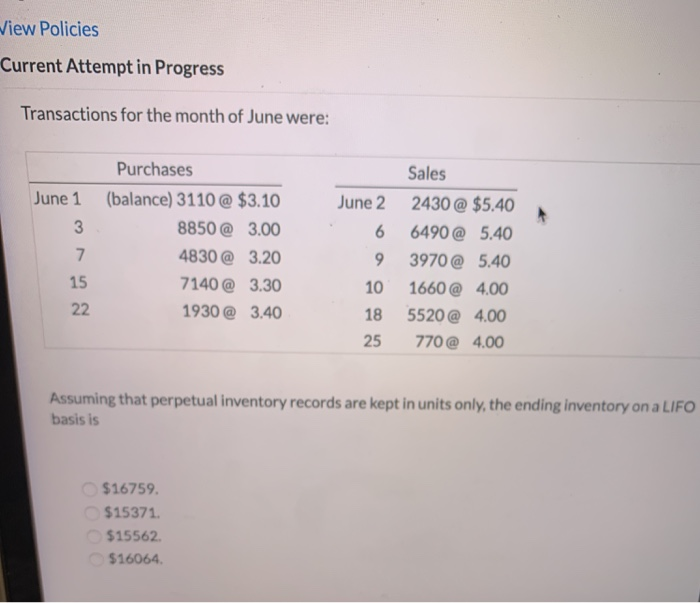

Question: View Policies Current Attempt in Progress Transactions for the month of June were: June 1 Purchases (balance) 3110 @ $3.10 8850 @ 3.00 4830 @

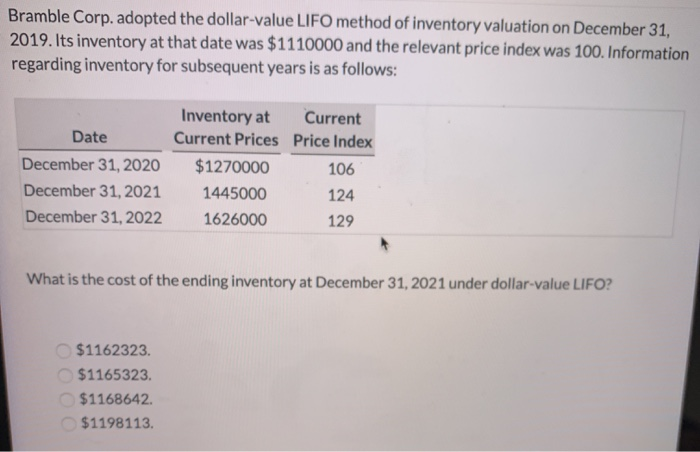

View Policies Current Attempt in Progress Transactions for the month of June were: June 1 Purchases (balance) 3110 @ $3.10 8850 @ 3.00 4830 @ 3.20 7140 @ 3.30 1930 @ 3.40 June 2 6 9 10 18 25 Sales 2430 @ $5.40 6490 @ 5.40 3970 @ 5.40 1660 @ 4.00 5520 @ 4.00 770 @ 4.00 Assuming that perpetual inventory records are kept in units only, the ending inventory on a LIFO basis is $16759. $15371 $15562. $16064 Bramble Corp. adopted the dollar-value LIFO method of inventory valuation on December 31. 2019. Its inventory at that date was $1110000 and the relevant price index was 100. Information regarding inventory for subsequent years is as follows: Date December 31, 2020 December 31, 2021 December 31, 2022 Inventory at Current Current Prices Price Index $1270000 106 1445000 124 1626000 129 What is the cost of the ending inventory at December 31, 2021 under dollar-value LIFO? $1162323 $1165323 $1168642 $1198113

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts