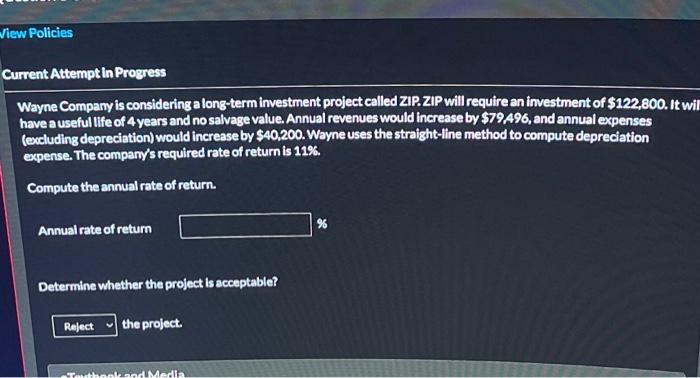

Question: View Policies Current Attempt in Progress Wayne Company is considering a long-term investment project called ZIP. ZIP will require an investment of $122,800. It will

Wayne Company is considering a long-term investment project called ZIP. ZIP will require an investment of $122,800. It wil have a usefultife of 4 years and no salvage value. Annual revenues would increase by $79A96, and annual expenses (excluding depreciation) would increase by $40,200. Woyne uses the straight-line method to compute depreciation expense. The compary/s required rate of return is 11%. Compute the annual rate of return. Annual rate of retum Determine whether the project is acceptable? the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts