Question: View Policies Current Attempt in Progress While reviewing last year's performance outcomes for comparison to this year, Debra finds several pieces are missing. Apparently,

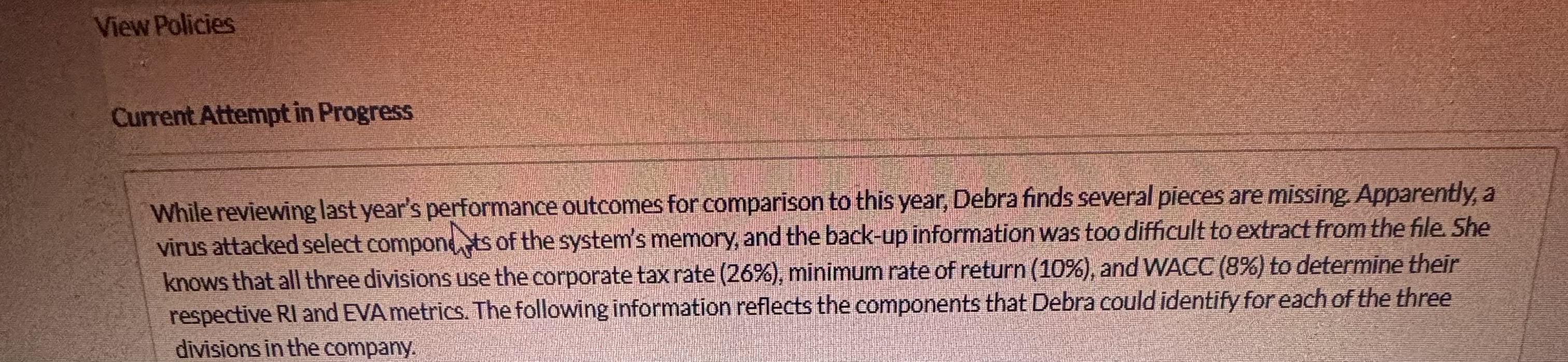

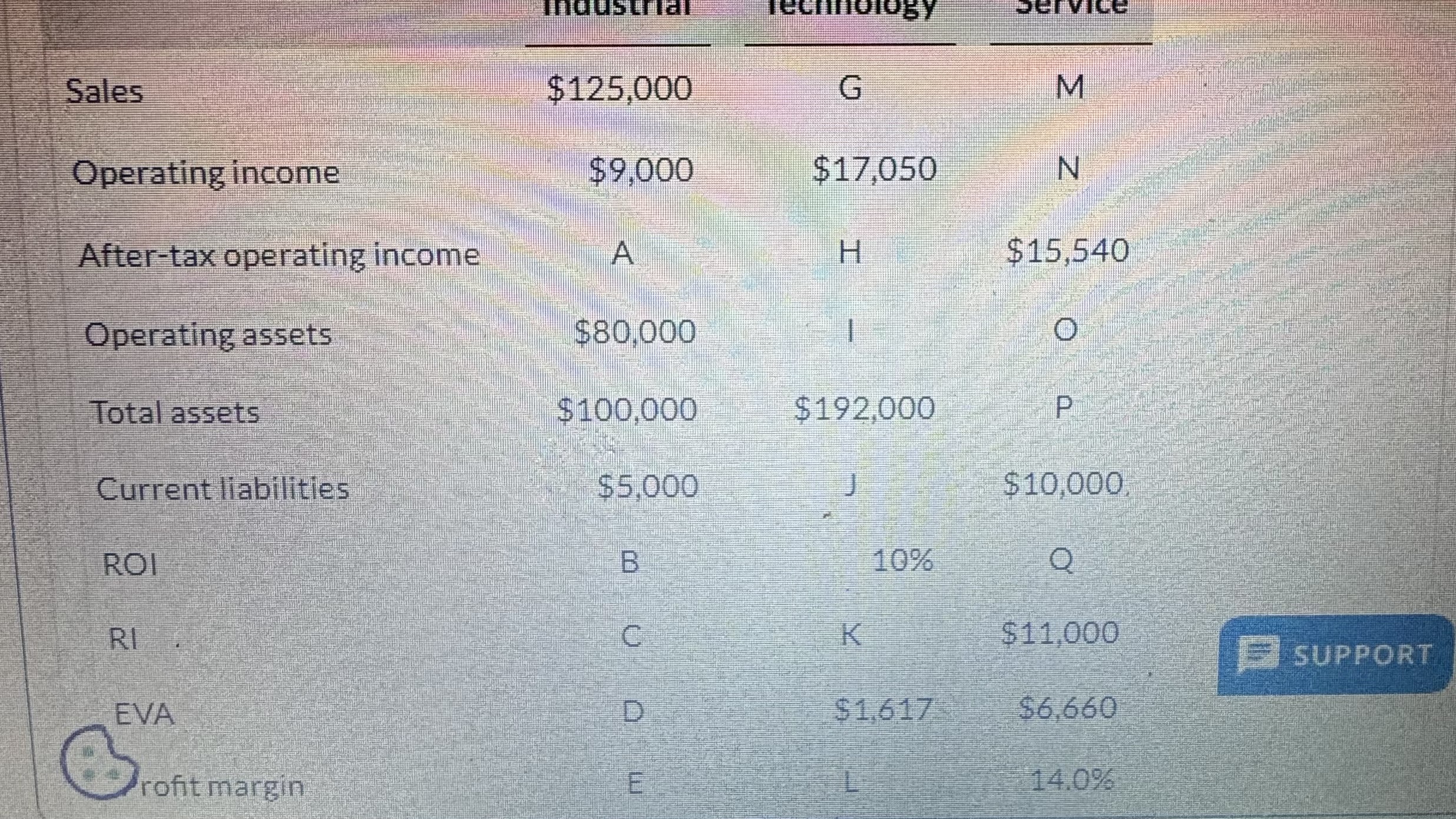

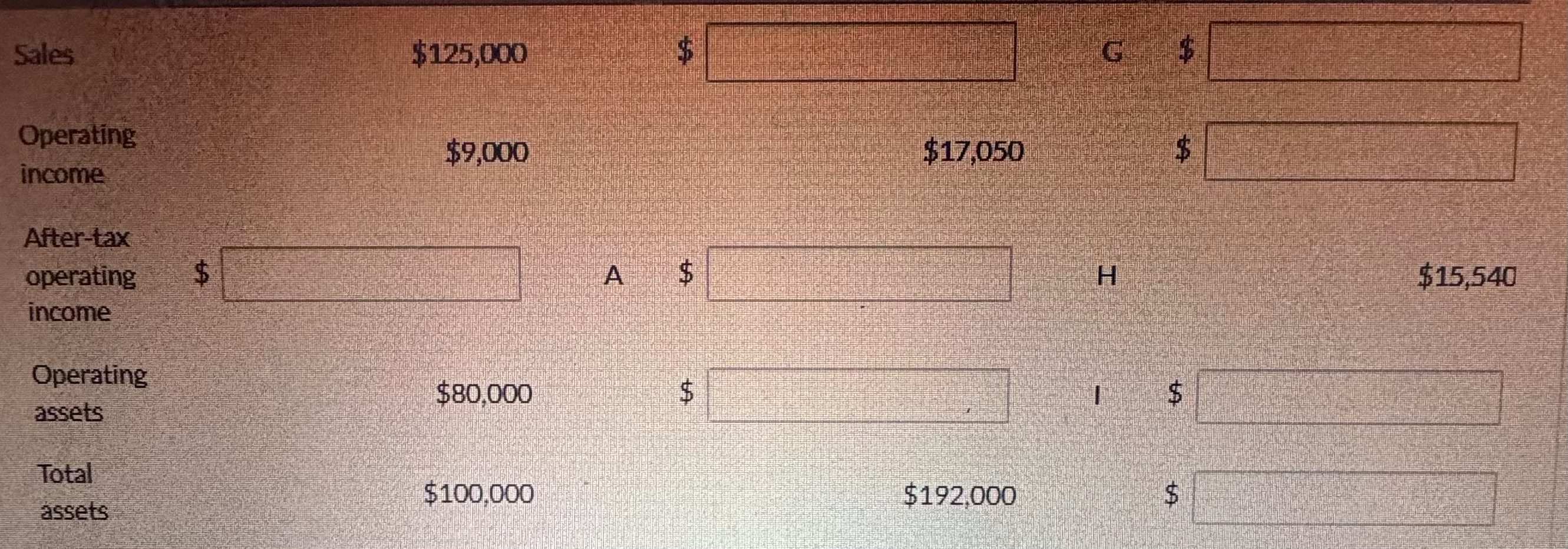

View Policies Current Attempt in Progress While reviewing last year's performance outcomes for comparison to this year, Debra finds several pieces are missing. Apparently, a virus attacked select components of the system's memory, and the back-up information was too difficult to extract from the file. She knows that all three divisions use the corporate tax rate (26%), minimum rate of return (10%), and WACC (8%) to determine their respective RI and EVA metrics. The following information reflects the components that Debra could identify for each of the three divisions in the company. mology Sales $125,000 G M Operating income $9,000 $17,050 N After-tax operating income A H $15,540 Operating assets $80,000 O Total assets $100,000 $192,000 P Current liabilities $5,000 J $10,000, ROI B 10% Q RI C K $11,000 SUPPORT EVA D $1.617 $6,660 rofit margin E 14.0% Sales Operating income After-tax operating $ income Operating assets Total $125,000 $ $9,000 A $ $80,000 $ +A $100,000 assets G $ $17,050 $ $192,000 T H $ A $15,540 Current liabilities ROI Residual $ income EVA Profit margin Asset turnover $ LA $5,000 %B C D % E $ $ 10% $1,617 F 2 $10,000 K $11,000 $6,660 % L 14.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts