Question: View Policies Current Attempt in Progress You are forecasting the returns for Carla Company, a plumbing supply company, which pays a current dividend of $9.60.

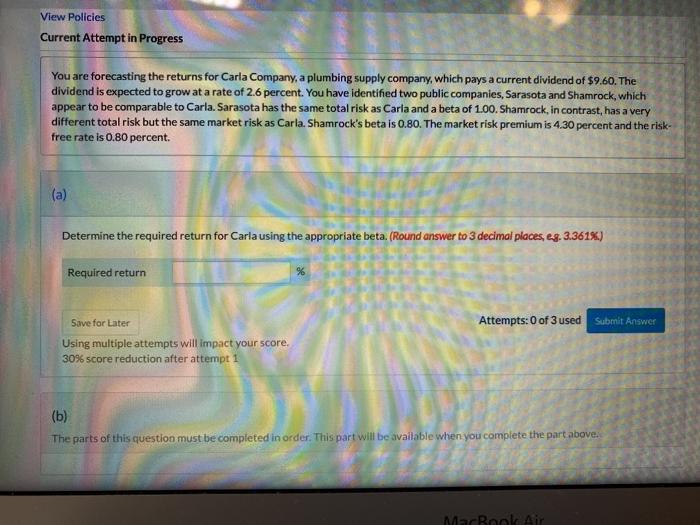

View Policies Current Attempt in Progress You are forecasting the returns for Carla Company, a plumbing supply company, which pays a current dividend of $9.60. The dividend is expected to grow at a rate of 2.6 percent. You have identified two public companies, Sarasota and Shamrock, which appear to be comparable to Carla. Sarasota has the same total risk as Carla and a beta of 1.00. Shamrock, in contrast, has a very different total risk but the same market risk as Carla. Shamrock's beta is 0.80. The market risk premium is 4.30 percent and the risk- free rate is 0.80 percent. (a) Determine the required return for Carla using the appropriate beta. (Round answer to 3 decimal places, eg. 3.361%) %6 Required return Attempts: 0 of 3 used Submit Answer Save for Later Using multiple attempts will impact your score. 30% score reduction after attempt 1 (b) The parts of this question must be completed in order. This part will be available when you complete the part above. MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts