Question: View Policies Show Altempt + Hestory Current Attempt in Progress Sunland Leasing Company signs an agreement on January 1 , 2 0 2 5 ,

View Policies

Show Altempt Hestory

Current Attempt in Progress

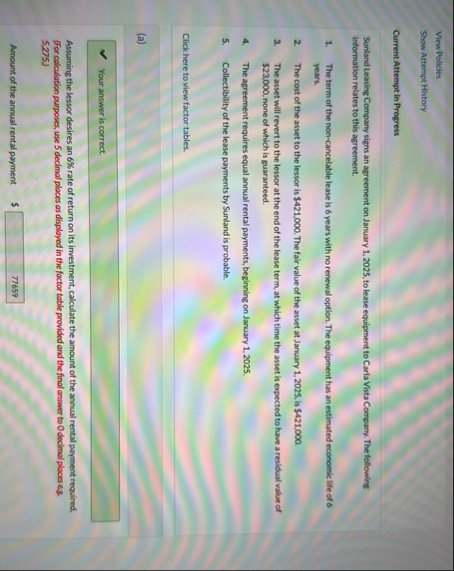

Sunland Leasing Company signs an agreement on January to lease equipment to Carla Vista Company. The following information relates to this agreement.

The term of the noncancelable lease is years with no renewal option. The equipment has an estimated economic life of years.

The cost of the asset to the lessor is $ The fair value of the asset at January is $

The asset will revert to the lessor at the end of the lease term, at which time the asset is expected to have a residual value of $ none of which is guaranteed.

The agreement requires equal annual rental payments, beginning on January

Collectibility of the lease payments by Sunland is probable.

Click here to view factor tables.

a

Your answer is correct.

Assuming the lessor desires an rate of return on its investment, calculate the amount of the annual rental payment required. For colculation purposes, use decimal ploces as displayed in the factor table provided and the final anower to decimal ploces ess.

Amount of the annual rental payment

$

Question of

Prepare an amortization schedule that is suitable for the lessor for the lease term. Round answers to declmal ploces ey

SUNLAND LEASING COMPANY lessor Lease Amortization Schedile

Annual Lease Payment

eTextbook and Media

List of Accounts

Last saved hours ago.

Attempts: of used

Swed work will be autosubmitted on the due date. Auto

Thabnk you!

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock