Question: View Policies Show Attempt History Current Attempt in Progress On April 1, 2020, Grouper Corp. sold 11,000 of its $900 face value, 15-year, 10% bonds

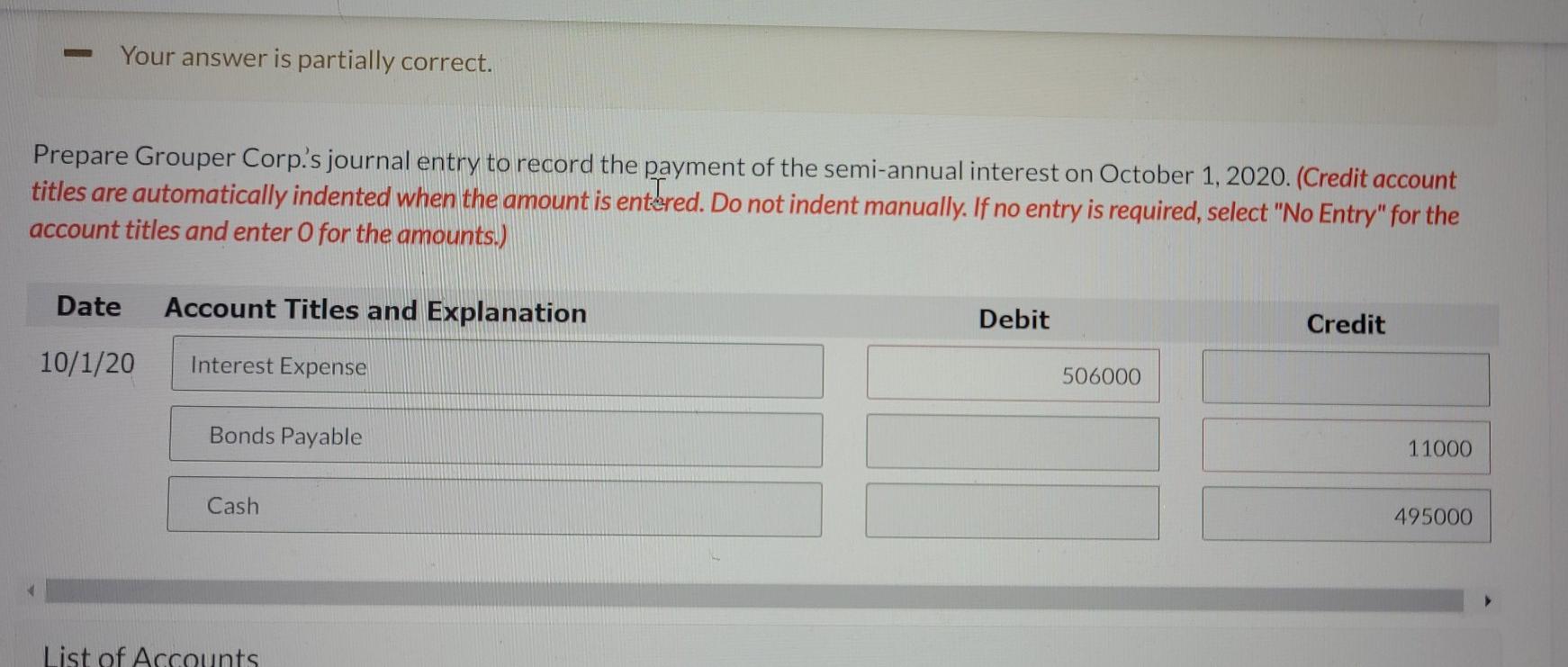

View Policies Show Attempt History Current Attempt in Progress On April 1, 2020, Grouper Corp. sold 11,000 of its $900 face value, 15-year, 10% bonds at 98. Interest payment dates are April 1 and October 1. The company follows ASPE and uses the straight-line method of bond discount amortization. On March 1, 2021, Grouper extinguished 2,750 of the bonds by issuing 80,000 shares. At this time, the accrued interest was paid in cash to the bondholders whose bonds were being extinguished. In a separate transaction on March 1, 2021, 120,000 of the company's shares sold for $32 per share. Your answer is partially correct. Prepare Grouper Corp.'s journal entry to record the payment of the semi-annual interest on October 1, 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit 10/1/20 Interest Expense 506000 Bonds Payable 11000 Cash 495000 List of Accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts