Question: View Policies Show Attempt History Current Attempt in Progress Presented below is information related to equipment owned by Swifty Company at December 3 1 ,

View Policies

Show Attempt History

Current Attempt in Progress

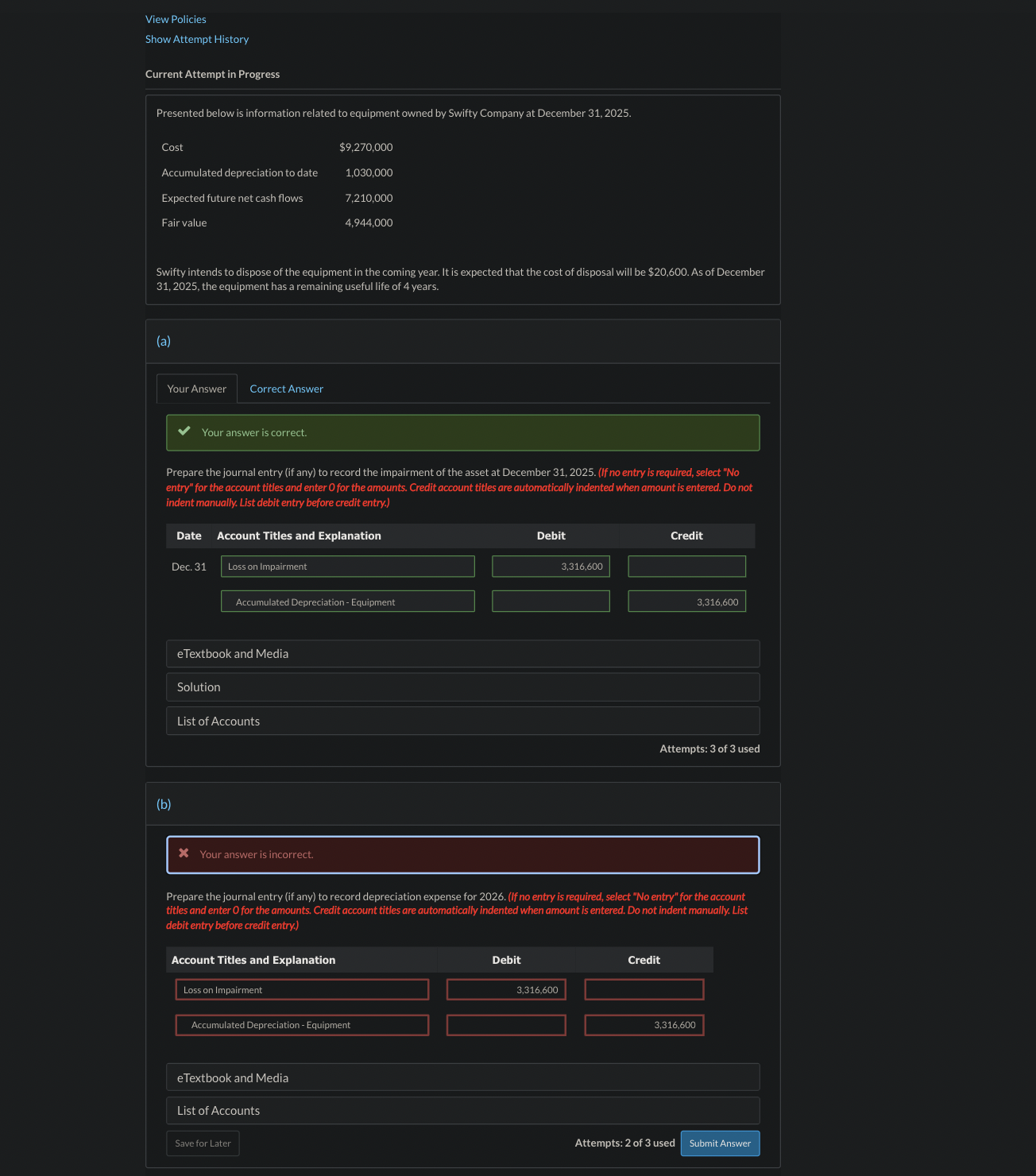

Presented below is information related to equipment owned by Swifty Company at December

Swifty intends to dispose of the equipment in the coming year. It is expected that the cost of disposal will be $ As of December the equipment has a remaining useful life of years.

a

Your Answer

Correct Answer

Your answer is correct.

Prepare the journal entry if any to record the impairment of the asset at December If no entry is required, select No entry" for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List debit entry before credit entry.

eTextbook and Media

Solution

List of Accounts

Attempts: of used

b

Your answer is incorrect.

Prepare the journal entry if any to record depreciation expense for If no entry is required, select No entry" for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List debit entry before credit entry.

Account Titles and Explanation

Debit

Credit

Loss on Impairment

Accumulated Depreciation Equipment

eTextbook and Media

List of Accounts

Save for Later

Attempts: of used

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock