Question: View Policies Show Attempt History Current Attempt in Progress Windsor Corporation had net income of $ 1 1 5 , 0 0 0 for the

View Policies

Show Attempt History

Current Attempt in Progress

Windsor Corporation had net income of $ for the fiscal year ending December The company pays income tax. For fiscal the weighted average number of common shares was Throughout fiscal Windsor had a $ bond that was convertible to common shares. On September the company sold another new $ bond that was convertible to common shares.

ae

Your answer is partially correct.

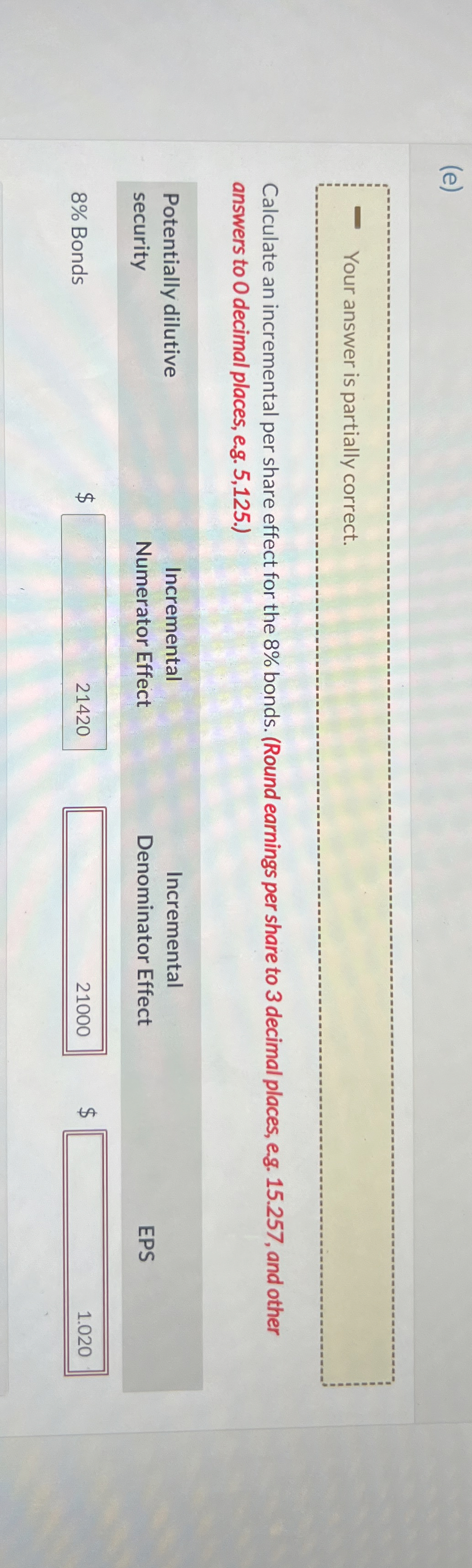

Calculate an incremental per share effect for the bonds. Round earnings per share to decimal places, eg and other answers to decimal places, eg

tabletablePotentially dilutivesecuritytableIncrementalNumerator EffecttableIncrementalDenominator Effect

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock