Question: View Policies Show Attempt History Current Attempt in Progress Your answer is partially correct. Waterway Corporation, which manufactures shoes, hired a recent college graduate to

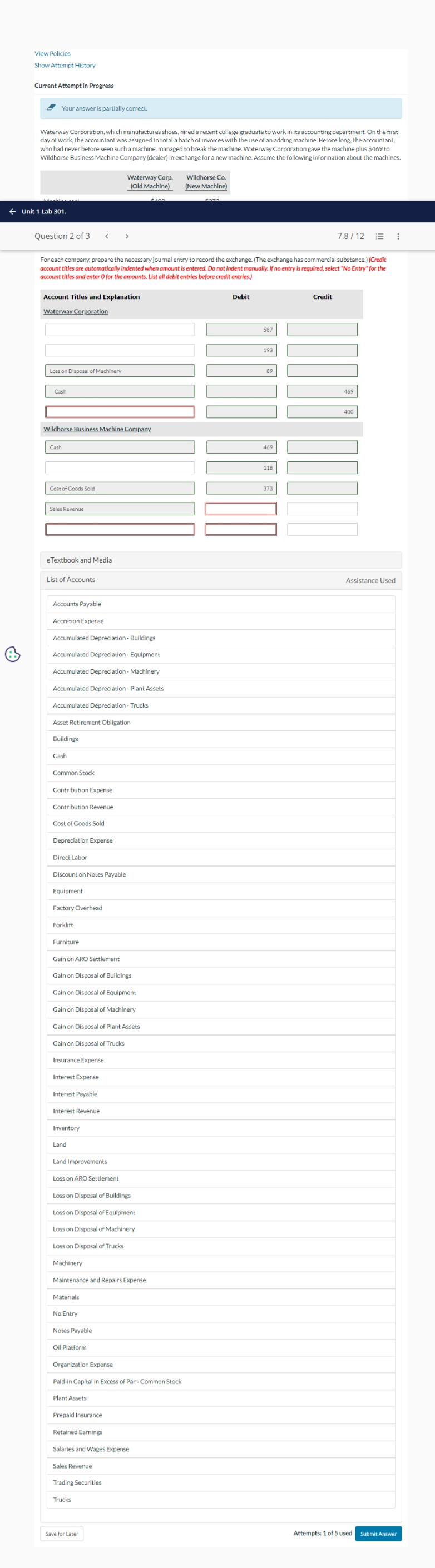

View Policies Show Attempt History Current Attempt in Progress Your answer is partially correct. Waterway Corporation, which manufactures shoes, hired a recent college graduate to work in its accounting department. On the first day of work, the accountant was assigned to total a batch of invoices with the use of an adding machine. Before long, the accountant o had never before seen such a machine, managed to break the machine. Waterway Corporation gave the machine plus $469 to Wildhorse Business Machine Company (dealer) in exchange for a new machine. Assume the following information about the machines. Waterway Corp. Wildhorse Co. (Old Machine) (New Machine) Unit 1 Lab 301. Question 2 of 3 7.8 / 12 = : For each company, prepare the necessary journal entry to record the exchange. (The exchange has commercial substance.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Debit Credit Waterway Corporation Loss on Disposal of Machinery Cash Wildhorse Business Machine Company Cash Cost of Goods Sold Sales Revenue e Textbook and Media List of Accounts Assistance Used Accounts Payable Accretion Expense Accumulated Depreciation - Buildings Accumulated Depreciation - Equipment Accumulated Depreciation - Machinery Accumulated Depreciation - Plant Assets Accumulated Depreciation - Trucks Asset Retirement Obligation Buildings Cash Common Stock Contribution Expense Contribution Revenue Cost of Goods Sold Depreciation Expense Direct Labor Discount on Notes Payable Equipment Factory Overhead Forklift Furniture Gain on ARO Settlement Gain on Disposal of Buildings Gain on Disposal of Equipment Gain on Disposal of Machinery Gain on Disposal of Plant Assets Gain on Disposal of Trucks Insurance Expense Interest Expense Interest Payable Interest Revenue Inventory Land Land Improvements Loss on ARO Settlement Loss on Disposal of Buildings Loss on Disposal of Equipment Loss on Disposal of Machinery Loss on Disposal of Trucks Machinery Maintenance and Repairs Expense Materials No Entry Notes Payable Oil Platform Organization Expense Paid-in Capital in Excess of Par - Common Stock Plant Assets Prepaid Insurance Retained Earnings Salaries and Wages Expense Sales Revenue Trading Securities Trucks Save for Later Attempts: 1 of 5 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts