Question: View previous attempt Check my work 9 2 points You are a financial adviser working with a client who wants to retire in eight years.

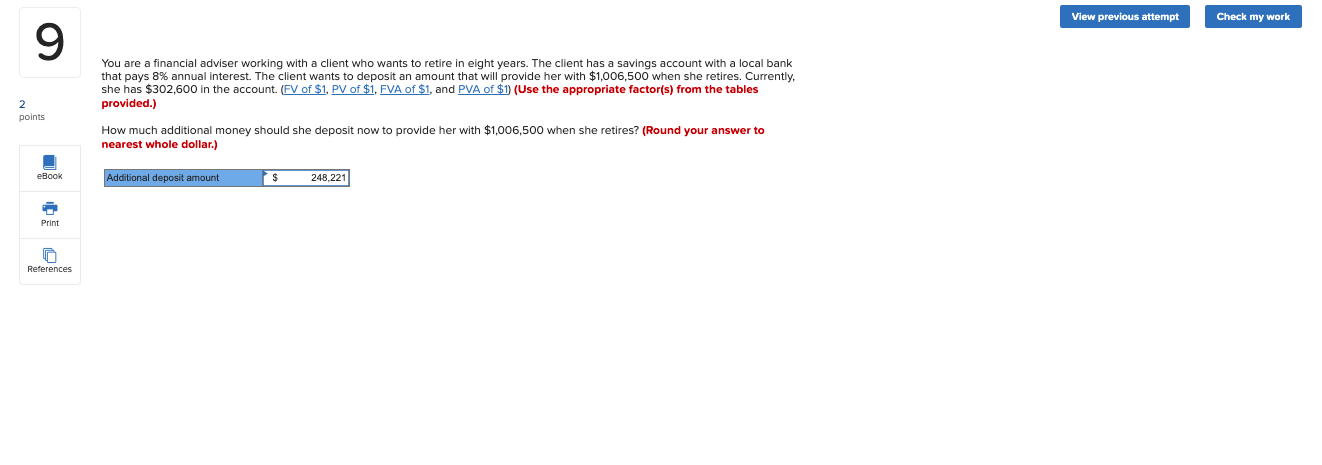

View previous attempt Check my work 9 2 points You are a financial adviser working with a client who wants to retire in eight years. The client has a savings account with a local bank that pays 8% annual interest. The client wants to deposit an amount that will provide her with $1,006,500 when she retires. Currently, she has $302.600 in the account. (FV of $1, PV of $1, FVA of $1, and PVA of $1 (Use the appropriate factor(s) from the tables provided.) How much additional money should she deposit now to provide her with $1,006,500 when she retires? (Round your answer to nearest whole dollar.) eBook Additional deposit amount $ 248.221 Print r References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts