Question: View V Tell me Insert y Xcut IL Copy le Format Draw Page Layout Calibri (Body) B I Formulas 11 A O A Data A

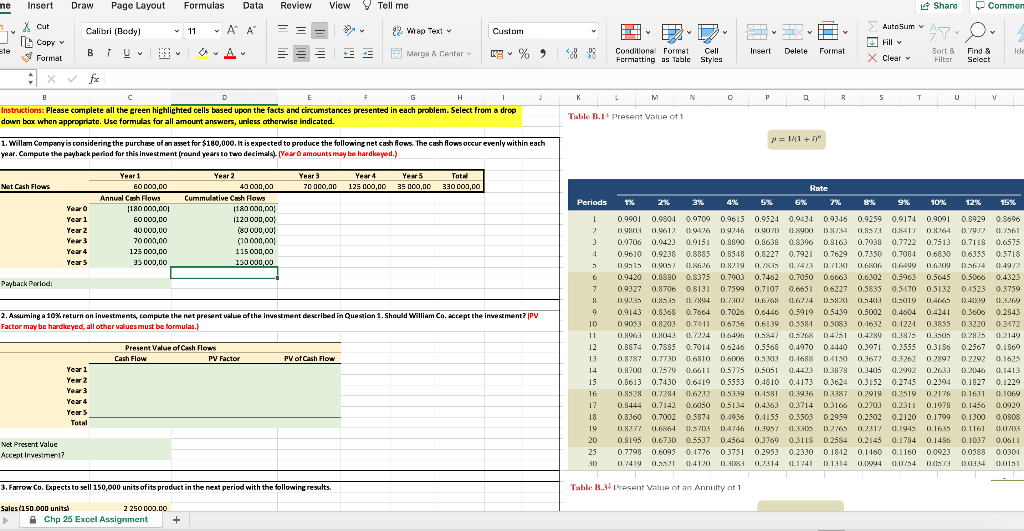

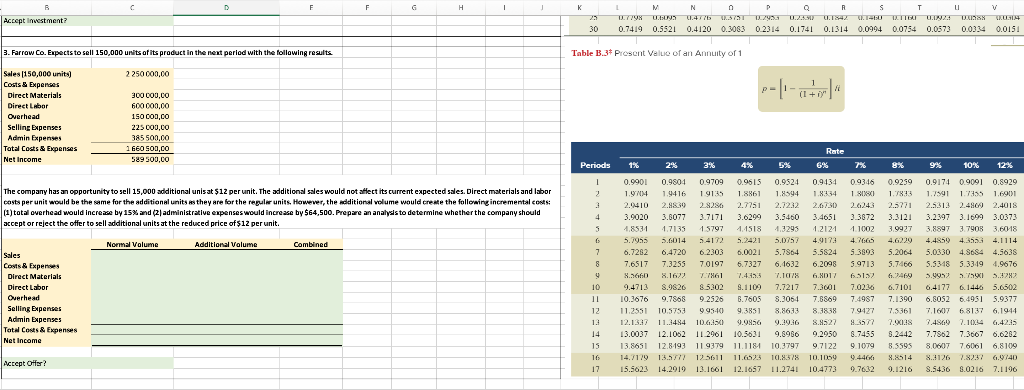

View V Tell me Insert y Xcut IL Copy le Format Draw Page Layout Calibri (Body) B I Formulas 11 A O A Data A Review = = E = P Autosum 22 Wrap Text Marga & Centar Custom ( % 2 P2 D Conditional Format E Insert Delete Share Commen 27-O Sort & Find & Ide Filter Select ) 8 Call Styles Format Formatting as Table X Clear Instructions: Please complete all the green highlighted cells based upon the facts and circumstances presented in each problem. Select from a drop down bar when appropriate. Use formulas for all amount answers, unless otherwise indicated. Table B.16 Present Value of 1 P = 1/1 +" 1. Willam Company is considering the purchase of asset for $180,000. It is expected to produce the following net cash flows. The cash flows occur evenly within each year. Compute the payback period for this investment (round years to two decimals (Year O amounts may be hard keyed.) Year 4 125 000,00 Year 5 35 000,00 Total 330 000.00 Net Cash Flows 60003,00 70 000,00 Rate Periods 1% 2% 3% 4 5% 6% 7% 8% 9% 10% 12% 15% Year o Year 1 Year 2 Year 3 Year 4 Years Annual Cash Flows 1180 000,001 EO 000,00 40 000.00 70000,00 125 000,00 35 000,00 Year 2 40 000,00 Cummulative Cash Flows 1189 000,00 1120 000,00 (80000,00) (19 000,00 115 000,00 130000.00 Payback Period: 7 2. Assuming a 10% return on investments, compute the net present value of the investment described in Question 1. Should William Ca. accept the investment? IPL Factor may be harde yed, all other values must be formulas. 9 10 11 12 09901 0.9804 0.9709 09615 0.9524 0.9434 09346 0.9259 D. (1.9612 0.9436 D9946 (IV ) (1.890 D8734 0.8573 09706 0.0423 0,91510.3800 0,8638 0,8306 03163 0.7039 0.9610 0.9238 0.8885 0.8548 0.8227 0.7921 0.7629 0.7350 D. 15 0. 9 7 (1.626 D8219 0.78 (1.7475 07131 0.656 0.9420 0.8SSO 0.8375 0.7903 0.7462 0.7050 0,6063 0.6302 09327 0.8706 0.8131075090.7107 0.6631 06227 0.5835 D9255 0.5 0.784 07302 01.6764 (.6274 0.5X10.54013 0.9143 0.8368 0.7664 0.7026 0.6146 0.5919 0.5439 0.5002 09053 0.8203 0.7411D6756 06139 0.3584050630_1632 D. ..i 0.8043 0.7224 0.649 0.5847 0.528 0.4751 0.4299 0.6874 0.7865 0.7014 06246 0.3366 0.4970 04440 0.3971 1.8787 0.7730 0.6810 D6006 0.5303 0,1688 04150 0.3677 0.9700 0.7570 0.6611 0.5735 0.5051 0.4423 0.3879 0.3405 0.8613 0.7430 0.6419 0.5553 0.4810 0.4173 0.3624 0.3152 1.8528 0.7284 0.6232053300ASX 0.3936 D 3387 0.1919 0.9444 0.7142 0.0050 05124 0. 4 3 0.3714 0.3166 0.270.3 0.8360 0.7002 0.5874 04936 0.41550.1503 0 2959 0.2502 D.8277 1.664 0.57025 0.4746 01.1957 15 02165 0.2317 .9195 0.6730 0.5537 0.4564 0.3769 0.3115 0.2584 0.2145 0.7798 0.609504776 0.375 0.29530.2330 01842 0.1460 0.7419 0.21 0.4120 D i 0.2314 (1.1741 D. 1414 0.11914 0.974 09091 0.8929 0.8696 (1.8417 0.x264 92 (.7561 0.7722 0.7513 0.7113 0.6575 0.7084 0.6830 0.6355 0.5718 (1.6699 0.62019 .5614 (149 72 0.5963 0.5045 0.5008 0.4323 0.5470 0.5132 0.4523 0.3759 (1.0119 0.4625 1.41X59 (1.5269 0.4604 0.4241 0.3606 0.2843 0.1224 0.3855 0.3220 0.2472 0.3875 Disc 0.2835 0.2149 0.3595 0.3186 0.2567 0.1869 0.3262 0.2897 D2292 0.1625 0.2992 0.2633 0.2046 0.1413 0.2745 0.2394 0.1827 0.1229 (1.2519 0.2176 0.1631 0.10169 0.2311 0.1079 0.1456 0.0929 0.2120 0.1799 0.1300 0.0008 (1.1945 0.1655 .1161 0.07133 0.1784 0.1436 0.1037 0.0611 01 160 0.0923 0.0988 0.0301 (10754 0.17: D.1434 (20131 Present Value of Cash Flows Cash Flow PV Factor PV of Cash Flow Year 1 Year 2 Year 4 Years 17 18 19 20 25 .30 0 Net Present Value Accept Investment? 3. Farrow Co. Expects to sell 150,000 units of its product in the next period with the following results. Table B.3 Present Value of an Annulty of 1 Sales(150.000 units 2250 COO.CO Chp 25 Excel Assignment + Accept Investment? 2 30 .77 0.7419 95 114776 1.371 0.5521 0.4120 0.3083 293 0.2314 0.2350 UTS42 50 0.1741 0.1314 0.0994 TTGN U 0.0754 W 0.0573 0.0334 W 0.0151 3. Farrow Co. Expects to sell 150,000 units of its product in the next period with the following results. Table B.3 Prosent Value of an Annuity of 1 2 250 000,00 -- |- atoml" Sales [150,000 units) Costs & Expenses Direct Materials Direct Labor Overhead Selling Expenses Admin Expenses Tatal Costs & Expenses Net Income 300 000,00 600 000,00 150 000,00 225 COU.CO 385 500,00 1 660 500.CO 589500,00 Rate 6% Periods 1% 2% 3% 4% 5% 7% 8% 9% 10% 12% The company has an opportunity to sell 15,000 additional unis at $12 per unit. The additional sales would not affect its current expected sales. Direct materials and labor costs per unit would be the same for the additional units as they are for the regular units. However, the additional volume would create the following incremental costs: 111)total overhead would increase by 15% and 2 administrative expenses would increase by $64,500. Prepare an analysis to determine whether the company should accept or reject the offer to sell additional units at the reduced price of $ 12 per unit. 5 Normal Volume Additional Volume Combined 7 Sales Coys & Expenses Direct Materials Direct Labor 0.9901 0.9804 0.9709 0.9615 0.9524 0.9134 09346 09259 09174 09091 0.8929 1.9AM 1.9416 19135 1.8861 1.8594 1.8334 1.80 1.7833 1.7991 1.7155 1.6901 2.0410 2.9530 2.9280 2,7251 2.72322.670) 2624 2.32712.531.3 2.480 2.401S 3.9020 3.6077 3.71713.6299 3.5460 3.4651 3.3872 3.31213.2397 3.1699 3.0373 48534 1,71351579744518 4,3295 12124 1100239927 38897 37908 3.6018 5.7955 5.6014 5.41725.2421 5.0357 4.9173 4.7665 4.62294.4859 4.355. 4.1114 6.7252 6.4720 6.2303 6.0021 5.7864 5.5524 5.3893 5.2064 5.0330 4.8684 4.5638 7.6517 7.3255 70197 6.7327 6.1632 6.2098 5.9713 5.74665.5348 5.3319 4.9676 5660 8.16727 7861 7.4.155 7.1178 6.8017 65157 6.2460 5.99525759 5.3282 .4713 8.0826 8 53029 .1109 7.7217 7.300 7.0236 6.7101 6.4177 6.1446 5.6502 10.36769.7868 9.2526 6.7605 8.30617.68697.4987 7.1390 6.8052 6.4951 5.9377 11.2551 10.5753 9954093851 8.863387838 79427 73361 7.16 6.8137 6.1944 12.137 11..484 10.6450 9.0856 9.39.36 8.8527 .3577 7.00138 3.4860 7.1034 6.4245 13.0037 12.1052 11 2961 10.5631 9.8966 9.2950 8.74558.2442 7.7862 7.3667 6.6262 13.865112.84193 119379 11.1184 10.3797 9712291079 3.5595 80607 76061 68109 14.7179 13.5771 125611 11.6525 11.8578 10.1009 9.4466 8.8514 8.126 7.8237 6.9740 15.5623 14.2010 13.1061 12.1657 11.2741 10.4773 0.7632 9.1216 S.5436 8.02.16 7.1196 9 10 11 Overhead Selling Expenses Admin Expenses Tatl Costs & Expenses Net Income Accept offer? 17

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts