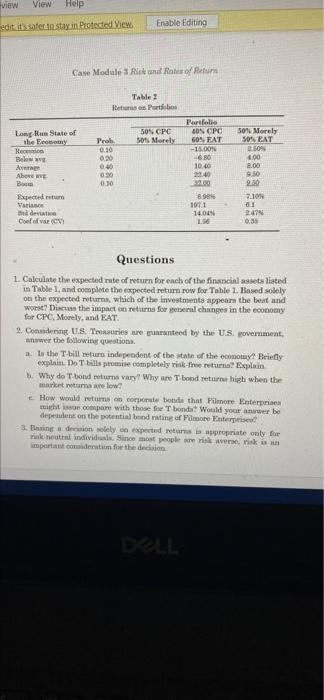

Question: View View Help edit. it's safe to stay in Protected View Enable Editing Case Modules and Rates of Return Table em Porto Long lum State

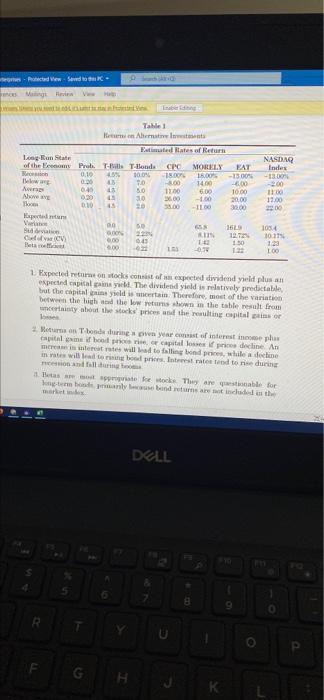

View View Help edit. it's safe to stay in Protected View Enable Editing Case Modules and Rates of Return Table em Porto Long lum State of the Economy Rece Below 50N CPC 5015 Morely Pro 0.10 0.20 0.40 030 0.10 Portfolio CON CPC GOS FAT -18.00 -60 10.40 22:40 50 Morel 50% EAT 3509 400 B.00 9.50 9.60 2.109 ALE Bom Expected retum 1991 14.00 2471 el de Coefoe Questions 1. Calculate the expected rate of return for each of the financial assets listed in Table 1, and complete the expected return row for Table 1. Based solely on the expected returns, which of the investments appears the best and worst? Discuss the impact on returns for general change in the economy for CPC, Morely, and EAT. 2. Considering US. Truries are paranteed by the U.S. yovernment awer the following questions at the bill return independent of the state of the economy Briefly explain. DoT bills promise completely risk-free returns Explain Why do bond turns vary! Why are bond return high when the market returns are low How would retums on porte bond that Filmore Enterprise might ice compare with those for bondat Would your awer be dependent on the potential bendrinting of more Enterprise? thing decisionelypected returns is appropriate only for riak neutral individuals. Since most people are risk verseink is an important consideration for the decision ALL wers hotellen Saw ng I Tahle Heren Alternate Emales of Return Icount of the Bom Prelivit Blond CNC MORELY EAT 0.10 10:04 -18.00 15.00% -- 1300 0. 45 . 100 14.00 6.00 0:40 * 30 1200 6.00 10.00 0.30 310 13.00 bo 0.10 30,00 500 300 petente 00 Bu 16 OC 12 0.00 045 6.00 1 150 LE -02 123 NASDAQ Index -13.00 -200 110 17.00 00 1054 10:17 123 100 1. Expected to works consist of an expected dividend yield plus all expected capital gainyllThe dividend yield is relatively predictable but the capital is disain. Therefore, most of the variation between the light the low runs shown in the table result from certainty about the stock prices at the ring ospitali 1. Met T bedring a war cost of interest in plus capital ini di capitale decline A mersin interest rates will lead to falling bonds, while de in te will lead to sing bores Interest rated to nell les site to work. They are stable for DELL Y F G H J K

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts