Question: vig Company report the note payable: S11-6 Computing and journalizing an employee's total pay Lucy Rose works at College of Fort Worth and is paid

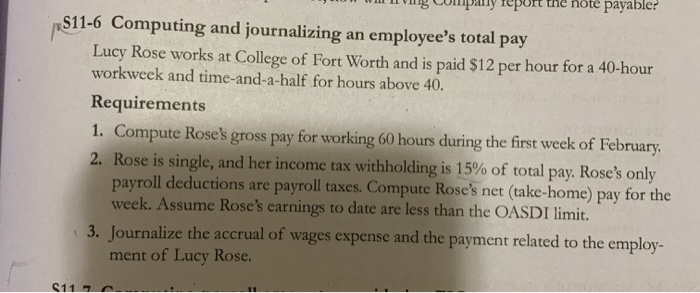

vig Company report the note payable: S11-6 Computing and journalizing an employee's total pay Lucy Rose works at College of Fort Worth and is paid $12 per hour for a 40-hour workweek and time-and-a-half for hours above 40. Requirements 1. Compute Rose's gross pay for working 60 hours during the first week of February. 2. Rose is single, and her income tax withholding is 15% of total pay. Rose's only payroll deductions are payroll taxes. Compute Rose's net (take-home) pay for the week. Assume Rose's earnings to date are less than the OASDI limit. 3. Journalize the accrual of wages expense and the payment related to the employ- ment of Lucy Rose. C11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts