Question: Vince and Pezev Everett recently approached you for help with their finances, their primary concern is retirement, but they also want to make sure they

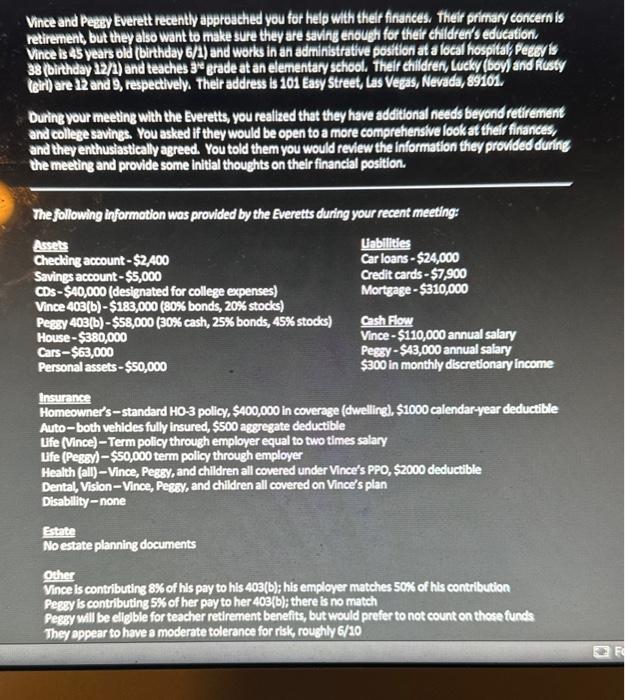

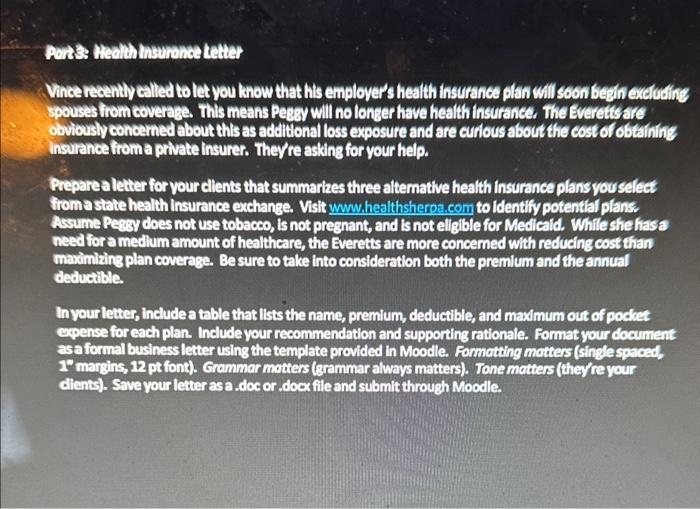

Vince and Pezev Everett recently approached you for help with their finances, their primary concern is retirement, but they also want to make sure they are saving enough for their children's edueation. Vince is 45 vears old (birthday 6/1 ) and works in an administrative position at a local hospitaly peegy is 38 (birthdyy 12/2 ) and teaches 38 grade at an elementary school. Their chilldren, Lucky (boy) and fusty (Gili) are 12 and 9, respectively. Their address is 101 Easy Street, Las Vegas, Nevada, 89101, During your meeting whth the Everetts, you realized that they have additional needs beyond retirement and college savings. You asked if they would be open to a more comprehensive look at their finances, and they enthusiastically agreed. You told them you would revew the information they provided during the meeting and provide some initial thoughts on their financial position. The following informotion wos provided by the Everetts during your recent meeting: Insurance Homeowner's - standard H0-3 polic, $400,000 in coverage (dwelline), $1000 calendaryear deductible Auto - both vehides fully insured, $500 aggegate deductible Ufe (Vince) - Term policy through employer equal to two times salary Ufe (Peses) - $50,000 term policy through employer Health (all) -Vince, Pegsy, and children all covered under Vince's PPO, 52000 deductible Dental, Vision - Vince, Pegar, and children all covered on Vince's plan Disability - none Estete Noestate planning documents apher Vince Is contributing 8% of his pay to his 403(b); his employer matches 50% of his contribution Pegzy is contributing 5% of her pay to her 403(b); there is no match Pegsy will be ellgble for teacher retirement benefits, but would prefer to not count on those funds They appear to have a moderate tolerance for risk, rouchly 6/20 Perts: meallh hasurence tetter Vhee reeently ealled to let you know that hits employer's heath insurance plan will soon begin exclucting spouses firom toverage. this means Pegay will no longer have health insurance. the Everetts are obviously concemed about this as additional loss exposure and are curtous about the cost of obtaining insurance froma private insurer. They're asking for your help. Prepare a letter for your clients that summarizes three altemative health insurance plans youselect from a state health Insurance exchange. Visit wuww. healthsheroa.com to identify potentlal plans, Assume Peezy does not use tobacco, is not pregnant, and is not elligible for Medicald. Whill she hasa need for a medlum amount of healthcare, the Everetts are more concemed with reducing cost than maximizing plan coverage. Be sure to take into consideration both the premium and the annual deductible. In your letter, include a table that lists the name, premium, deductible, and maximum out of pocket expense for each plan. Include your recommendation and supporting rationale. Format your document asa formal business letter using the template provided in Moodle. Formatting motters (single spaced, 1" mareins, 12 pt font). Grammar motters (grammar always matters). Tone motters (theyre your clients). Save your letter as a doc or docx file and submit through Moodle

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts