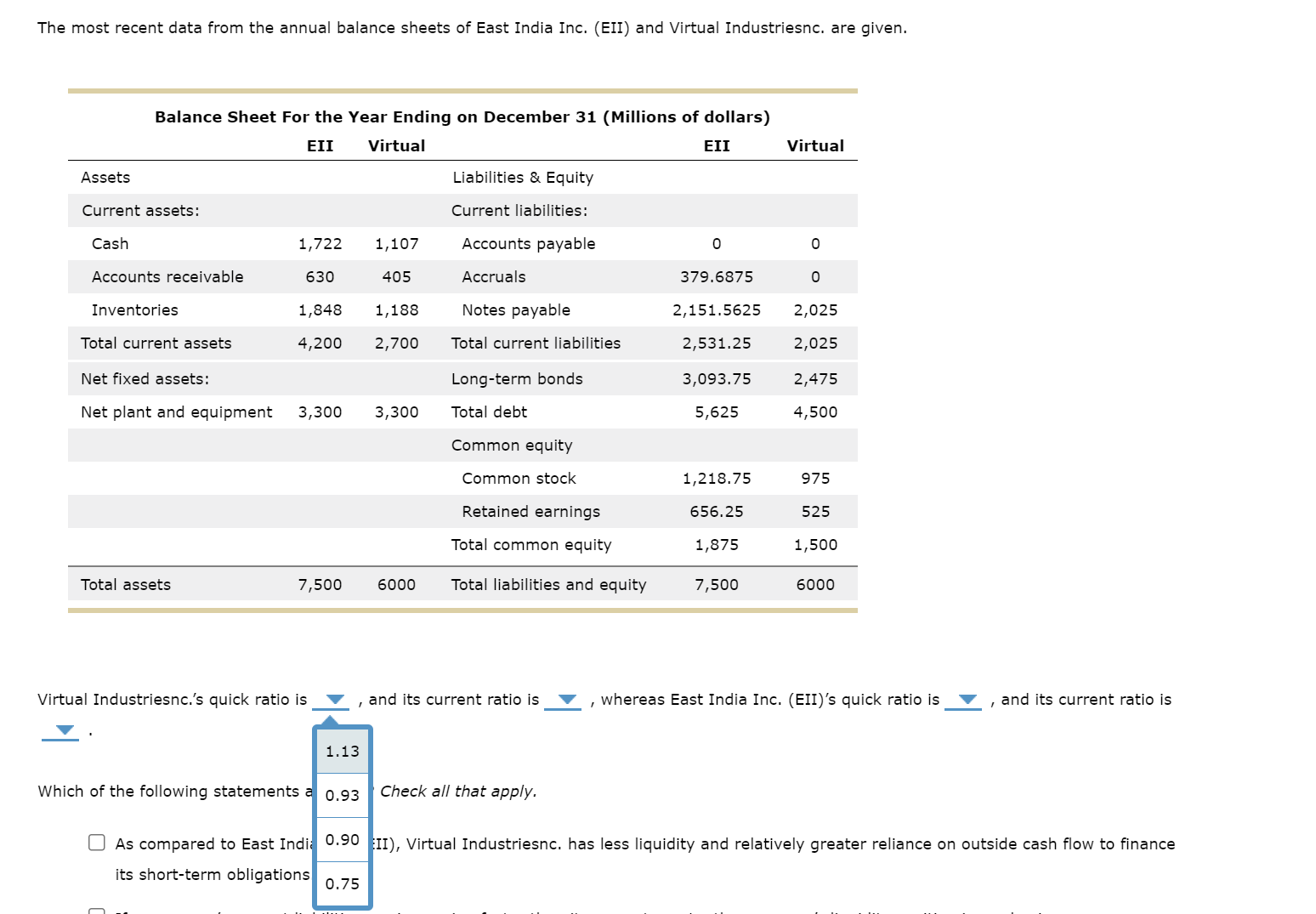

Question: Virtual Industriesnc. s quick ratio is , and its current ratio is , whereas East India Inc. ( EII ) s quick ratio is ,

Virtual Industriesnc.s quick ratio is and its current ratio is whereas East India Inc. EIIs quick ratio is and its current ratio is

Which of the following statements are true? Check all that apply.

As compared to East India Inc. EII Virtual Industriesnc. has less liquidity and relatively greater reliance on outside cash flow to finance its shortterm obligations.

If a companys current liabilities are increasing faster than its current assets, the companys liquidity position is weakening.

An increase in the quick ratio over time usually means that the companys liquidity position is improving.

Virtual Industriesnc. has a better ability to meet its shortterm liabilities than East India Inc. EII

An increase in the current ratio over time would always mean that the companys liquidity position is improving.

One of the most important assumptions behind the calculation of quick ratio is that:

The firms accounts receivables can be collected and converted into cash within the time period for which credit was granted

The firms inventories are highly liquid and can be sold quickly with minimal loss of value to assist in the settlement of the firms financial obligations

The firms accounts receivables will be collected late after the expiration of the credit period or are uncollectible

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock