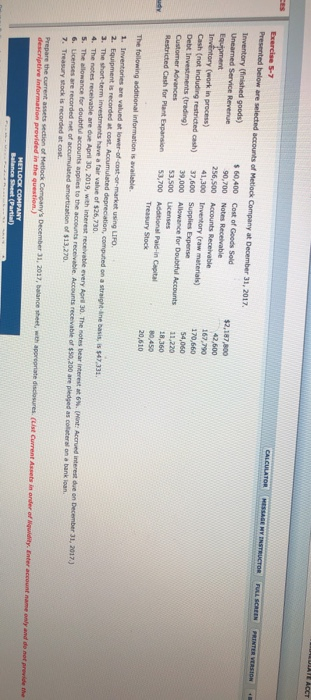

Question: VITE ACCT CALCULATOR MESSAGE MY INSTRUCTOR FULL SCREEN PRINTER VERSION Exercise 5-7 Presented below are selected accounts of Metiock Company at December 31, 2017 Inventory

VITE ACCT CALCULATOR MESSAGE MY INSTRUCTOR FULL SCREEN PRINTER VERSION Exercise 5-7 Presented below are selected accounts of Metiock Company at December 31, 2017 Inventory (finished goods) $ 60,400 Cost of Goods Sold Uneared Service Revenue 90,700 Notes Receivable Equipment 256,500 Accounts Receivable Inventory (work in process) 41,300 Inventory raw materials Cash (not including restricted cash) 37.500 Suplies Expense Debt Investments (trading) 39.000 Allowance for Doual Accounts Customer Advances 53,500 Licenses Restricted Cash for Plant Expansion 53,700 Additional Paid C ita Treasury Stock $2,187,800 12,600 167.790 170,660 54,060 11,220 18,360 10,450 20,610 The following additional information is available 1. Inventories are valued at lower-of-cost LO 2. Equipment is recorded at . Accumulated depreciation, computed on a str e ss is 547331 3. The short-term investments have a fair value of $26,730 4. The notes receivable are cut April 10, 2019, with interest r ate every for 30. The notes barrest N ot: Accuenterest due on December 31, 2017) 5. The allowance for doubtful accounts applies to the accounts receivable Accounts receive of $50.00 replied ascoltaton a bank 6. Ucenses are recorded net of accumulated amortization of $13,270 7. Treasury stock is recorded at cost. Prepare the current assets section of Metrock Company's December 31, 2017, balance sheet with coronate closures Current A a rderoot ter descriptive information provided in the question.) HETLOOK COMPANY ance Sheet (Partial) y

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts