Question: w Click here to read the eBook: The Relationship Between Risk and Rates of Return CAPM AND REQUIRED RETURN HR Industries (HRT) has a bets

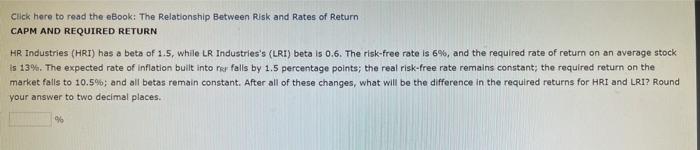

w Click here to read the eBook: The Relationship Between Risk and Rates of Return CAPM AND REQUIRED RETURN HR Industries (HRT) has a bets of 1.5, while LR Industries's (LRI) beta is 0.6. The risk-free rate is 6%, and the required rate of return on an average stock is 13%. The expected rate of Inflation built into per falls by 1.5 percentage points; the real risk-free rate remains constant; the required return on the market falls to 10.5%; and all betas remain constant. After all of these changes, what will be the difference in the required returns for HRI and LRI? Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock