Question: W e real rate of return plus u expected inflation premium. B) a risk premium. C) both an inflation and a risk premium. D) the

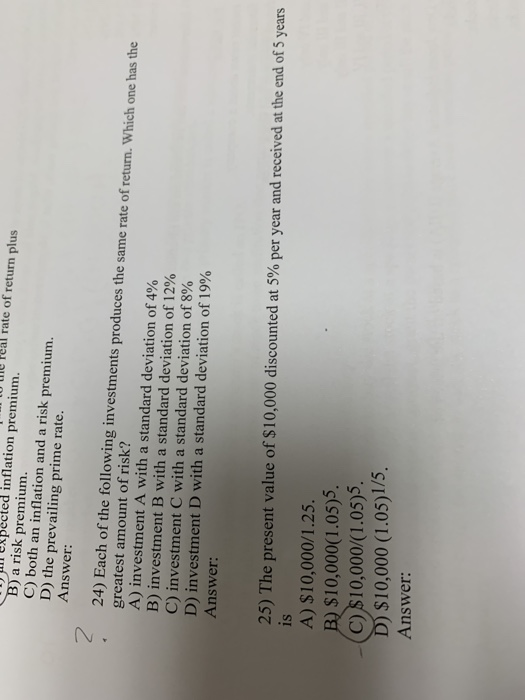

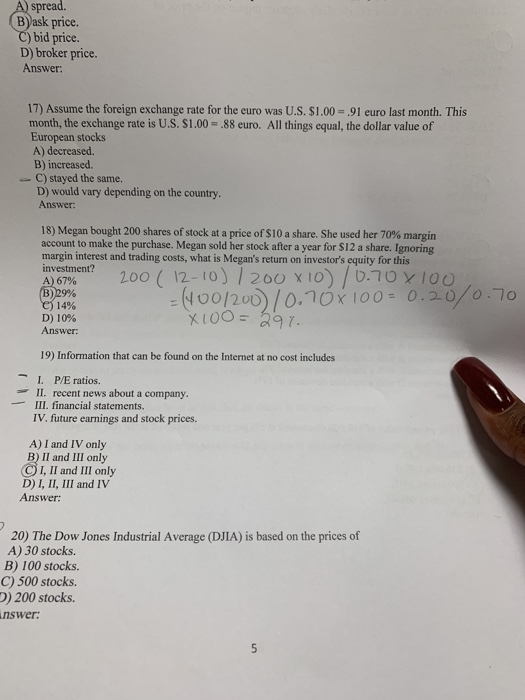

W e real rate of return plus u expected inflation premium. B) a risk premium. C) both an inflation and a risk premium. D) the prevailing prime rate. Answer: greatest amount of risk? 24) Each of the following investments produces the same rate of return. Which one has the A) investment A with a standard deviation of 4% B) investment B with a standard deviation of 12% C) investment C with a standard deviation of 8% D) investment D with a standard deviation of 19% Answer: 25) The present value of $10,000 discounted at 5% per year and received at the end of 5 years A) $10,000/1.25. B) $10,000(1.05)5 -(C) $10,000/(1.05)5. D) $10,000 (1.05)1/5. Answer: A) spread. Blask price. C) bid price. D) broker price. Answer: 17) Assume the foreign exchange rate for the euro was U.S. $1.00 - 91 euro last month. This month, the exchange rate is U.S. $1.00 = .88 euro. All things equal, the dollar value of European stocks A) decreased. B) increased -C) stayed the same. D) would vary depending on the country. Answer: 18) Megan bought 200 shares of stock at a price of S10 a share. She used her 70% margin account to make the purchase. Megan sold her stock after a year for S12 a share. Ignoring margin interest and trading costs, what is Megan's return on investor's equity for this investment? A) 67% 200 ( 12-10) / 2008 10 /0.70x100 B) 29% e) 14% D) 10% X100 = 297. Answer: = (400/200) /0.70 X 100 = 0.20/0.70 19) Information that can be found on the Internet at no cost includes - I P/E ratios. II. recent news about a company. III. financial statements. IV. future earnings and stock prices. A) I and IV only B) II and III only C) I, II and III only D) I, II, III and IV Answer: 20) The Dow Jones Industrial Average (DJIA) is based on the prices of A) 30 stocks. B) 100 stocks. C) 500 stocks. D) 200 stocks. nswer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts