Question: W ME HOW BE 8-2 Allowance method Obj. 4 Journalize the following transactions, using the allowance method of accounting for uncollectible receivables: Mar. 17. Received

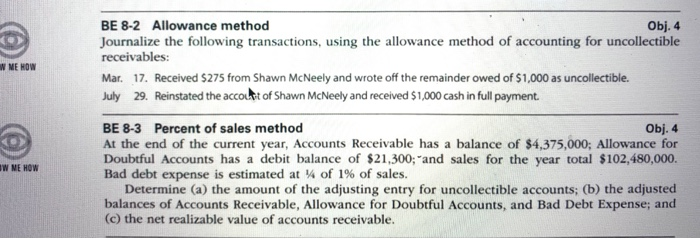

W ME HOW BE 8-2 Allowance method Obj. 4 Journalize the following transactions, using the allowance method of accounting for uncollectible receivables: Mar. 17. Received $275 from Shawn McNeely and wrote off the remainder owed of $1,000 as uncollectible. July 29. Reinstated the account of Shawn McNeely and received $1,000 cash in full payment. BE 8-3 Percent of sales method Obj. 4 At the end of the current year, Accounts Receivable has a balance of $4,375,000; Allowance for Doubtful Accounts has a debit balance of $21,300; "and sales for the year total $102,480,000. Bad debt expense is estimated at of 1% of sales. Determine (a) the amount of the adjusting entry for uncollectible accounts; (b) the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense; and the net realizable value of accounts receivable. W ME HOW

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts