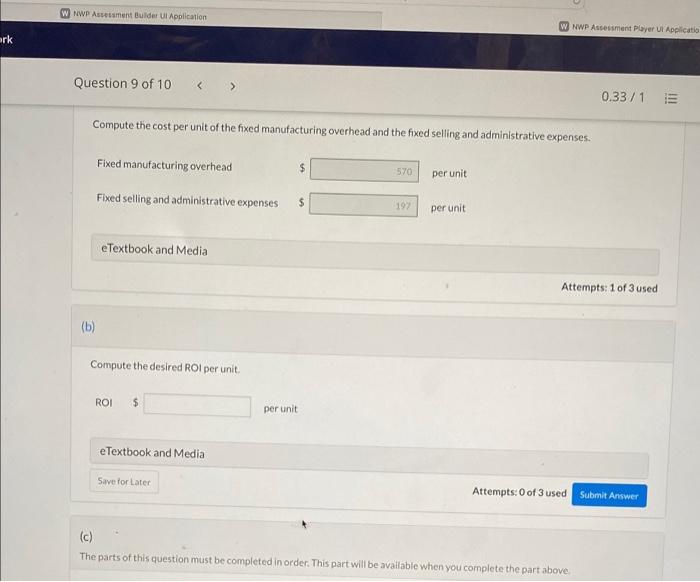

Question: W NWP Assessment Builder Ul Application W NWP Assessment Player Ul Applicatio ark Question 9 of 10 0.33/1 Compute the cost per unit of the

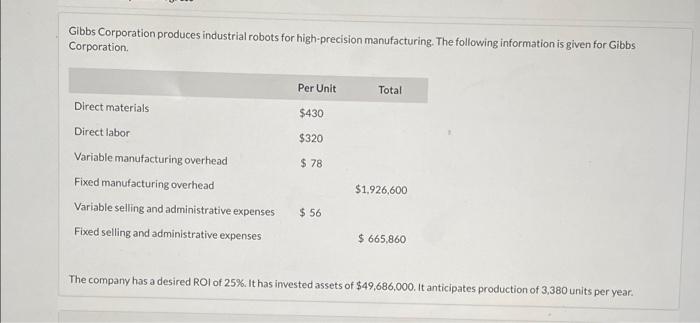

W NWP Assessment Builder Ul Application W NWP Assessment Player Ul Applicatio ark Question 9 of 10 0.33/1 Compute the cost per unit of the fixed manufacturing overhead and the fixed selling and administrative expenses. Fixed manufacturing overhead 570 per unit Fixed selling and administrative expenses $ 192 per unit eTextbook and Media Attempts: 1 of 3 used (b) Compute the desired ROI per unit. ROI per unit e Textbook and Media Save for Later Attempts: 0 of 3 used Submit Answer (c) The parts of this question must be completed in order. This part will be available when you complete the part above Gibbs Corporation produces industrial robots for high-precision manufacturing. The following information is given for Gibbs Corporation Per Unit Total Direct materials $430 Direct labor $320 $ 78 Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative expenses Fixed selling and administrative expenses $1.926,600 $ 56 $ 665,860 The company has a desired ROI of 25%. It has invested assets of $49,686,000. It anticipates production of 3,380 units per year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts