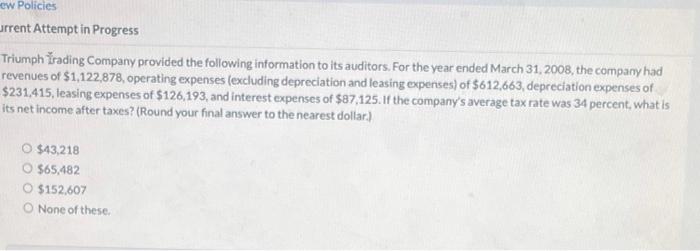

Question: w Policies urrent Attempt in Progress Triumph Trading Company provided the following information to its auditors. For the year ended March 31, 2008, the company

w Policies urrent Attempt in Progress Triumph Trading Company provided the following information to its auditors. For the year ended March 31, 2008, the company had revenues of $1,122,878, operating expenses (excluding depreciation and leasing expenses) of $612,663, depreciation expenses of $231,415, leasing expenses of $126,193, and interest expenses of $87,125. If the company's average tax rate was 34 percent, what is its net income after taxes? (Round your final answer to the nearest dollar) $43,218 O $65,482 $152,607 None of these

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts