Question: * W PS Course: ACX C estion 7 X M Inbox (63) mp/34499396/blockquickmail/attachment_log/88112/Exam%2021st.pdf?forcedownload 1 1/5 Question 2 (15 marks) Gamma Ltd. acquired a tract of

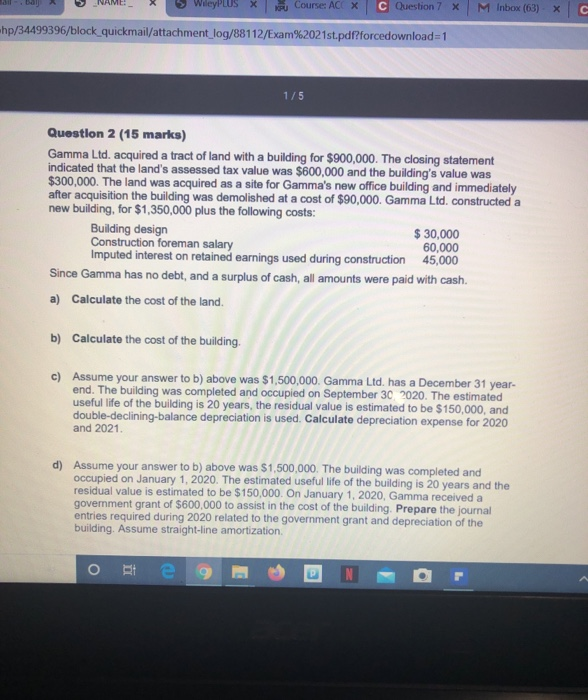

* W PS Course: ACX C estion 7 X M Inbox (63) mp/34499396/blockquickmail/attachment_log/88112/Exam%2021st.pdf?forcedownload 1 1/5 Question 2 (15 marks) Gamma Ltd. acquired a tract of land with a building for $900,000. The closing statement indicated that the land's assessed tax value was $600,000 and the building's value was $300,000. The land was acquired as a site for Gamma's new office building and immediately after acquisition the building was demolished at a cost of $90,000. Gamma Ltd. constructed a new building, for $1,350,000 plus the following costs: Building design $ 30,000 Construction foreman salary 60,000 Imputed interest on retained earnings used during construction 45,000 Since Gamma has no debt, and a surplus of cash, all amounts were paid with cash a) Calculate the cost of the land. b) Calculate the cost of the building. c) Assume your answer to b) above was $1,500,000. Gamma Ltd. has a December 31 year- end. The building was completed and occupied on September 30 2020. The estimated useful life of the building is 20 years, the residual value is estimated to be $150,000, and double-declining balance depreciation is used. Calculate depreciation expense for 2020 and 2021 d) Assume your answer to b) above was $1,500,000. The building was completed and occupied on January 1, 2020. The estimated useful life of the building is 20 years and the residual value is estimated to be $150,000. On January 1, 2020. Gamma received a government grant of $600,000 to assist in the cost of the building. Prepare the journal entries required during 2020 related to the government grant and depreciation of the building. Assume straight-line amortization o te 9 DNF * W PS Course: ACX C estion 7 X M Inbox (63) mp/34499396/blockquickmail/attachment_log/88112/Exam%2021st.pdf?forcedownload 1 1/5 Question 2 (15 marks) Gamma Ltd. acquired a tract of land with a building for $900,000. The closing statement indicated that the land's assessed tax value was $600,000 and the building's value was $300,000. The land was acquired as a site for Gamma's new office building and immediately after acquisition the building was demolished at a cost of $90,000. Gamma Ltd. constructed a new building, for $1,350,000 plus the following costs: Building design $ 30,000 Construction foreman salary 60,000 Imputed interest on retained earnings used during construction 45,000 Since Gamma has no debt, and a surplus of cash, all amounts were paid with cash a) Calculate the cost of the land. b) Calculate the cost of the building. c) Assume your answer to b) above was $1,500,000. Gamma Ltd. has a December 31 year- end. The building was completed and occupied on September 30 2020. The estimated useful life of the building is 20 years, the residual value is estimated to be $150,000, and double-declining balance depreciation is used. Calculate depreciation expense for 2020 and 2021 d) Assume your answer to b) above was $1,500,000. The building was completed and occupied on January 1, 2020. The estimated useful life of the building is 20 years and the residual value is estimated to be $150,000. On January 1, 2020. Gamma received a government grant of $600,000 to assist in the cost of the building. Prepare the journal entries required during 2020 related to the government grant and depreciation of the building. Assume straight-line amortization o te 9 DNF

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts