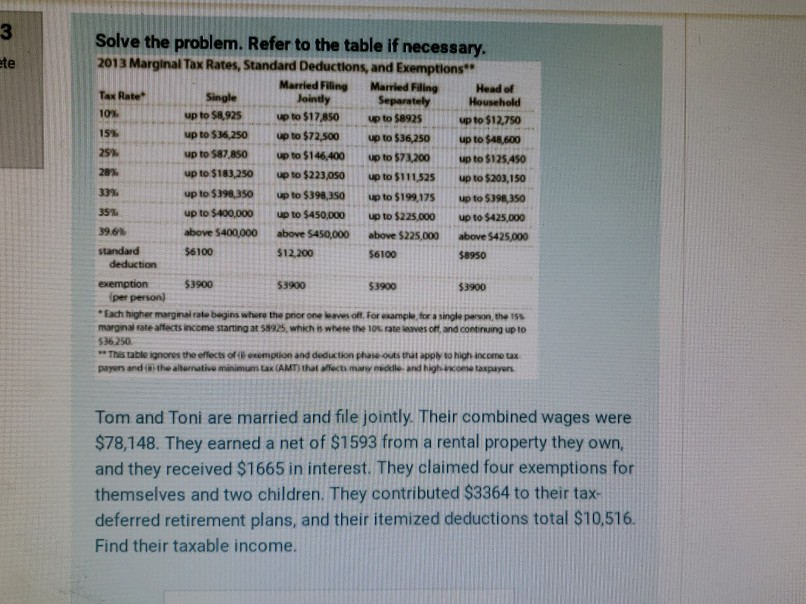

Question: w Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductions, and Exemptions Married Fling Married Filling Tax Rate Head

w Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductions, and Exemptions Married Fling Married Filling Tax Rate Head of Single Jointly Separately Household up to $8.925 up to $17.850 up to $8925 up to $12.750 up to $36.250 up to $72,500 up to $36,250 up to $48,600 up to $87.850 up to $146,400 up to $73,200 up to $125.450 up to $183,250 up to $223,050 up to $111.525 up to $203,150 up to $398,350 up to $398,350 up to $199,175 up to $398,350 up to $400,000 up to $450,000 up to $225,000 up to $425,000 above $400,000 above $450,000 above $225,000 above $425,000 standard $6100 $12.200 $6100 $8950 deduction exemption $3900 53900 $3900 $3900 (per person) "Each higher marginal rate begins where the prior one leaves of Foresample for a single person, the 18 marginal rate affects income starting at 58925, which is where the 10. rate awesoft, and continuing up to 536,250 **This table ignores the effects of exemption and deduction phase outstapply to high income tax payers and to the alternative minimum tax (AMT that fects ma e and high come taxpayers Tom and Toni are married and file jointly. Their combined wages were $78,148. They earned a net of $1593 from a rental property they own, and they received $1665 in interest. They claimed four exemptions for themselves and two children. They contributed $3364 to their tax- deferred retirement plans, and their itemized deductions total $10,516. Find their taxable income. w Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductions, and Exemptions Married Fling Married Filling Tax Rate Head of Single Jointly Separately Household up to $8.925 up to $17.850 up to $8925 up to $12.750 up to $36.250 up to $72,500 up to $36,250 up to $48,600 up to $87.850 up to $146,400 up to $73,200 up to $125.450 up to $183,250 up to $223,050 up to $111.525 up to $203,150 up to $398,350 up to $398,350 up to $199,175 up to $398,350 up to $400,000 up to $450,000 up to $225,000 up to $425,000 above $400,000 above $450,000 above $225,000 above $425,000 standard $6100 $12.200 $6100 $8950 deduction exemption $3900 53900 $3900 $3900 (per person) "Each higher marginal rate begins where the prior one leaves of Foresample for a single person, the 18 marginal rate affects income starting at 58925, which is where the 10. rate awesoft, and continuing up to 536,250 **This table ignores the effects of exemption and deduction phase outstapply to high income tax payers and to the alternative minimum tax (AMT that fects ma e and high come taxpayers Tom and Toni are married and file jointly. Their combined wages were $78,148. They earned a net of $1593 from a rental property they own, and they received $1665 in interest. They claimed four exemptions for themselves and two children. They contributed $3364 to their tax- deferred retirement plans, and their itemized deductions total $10,516. Find their taxable income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts