Question: W w AutoSave On Securities Tutorial S4 . Saved Search (Alt+Q) Dacian Letts File Home Insert Draw Design Layout References Mailings Review View Help Comments

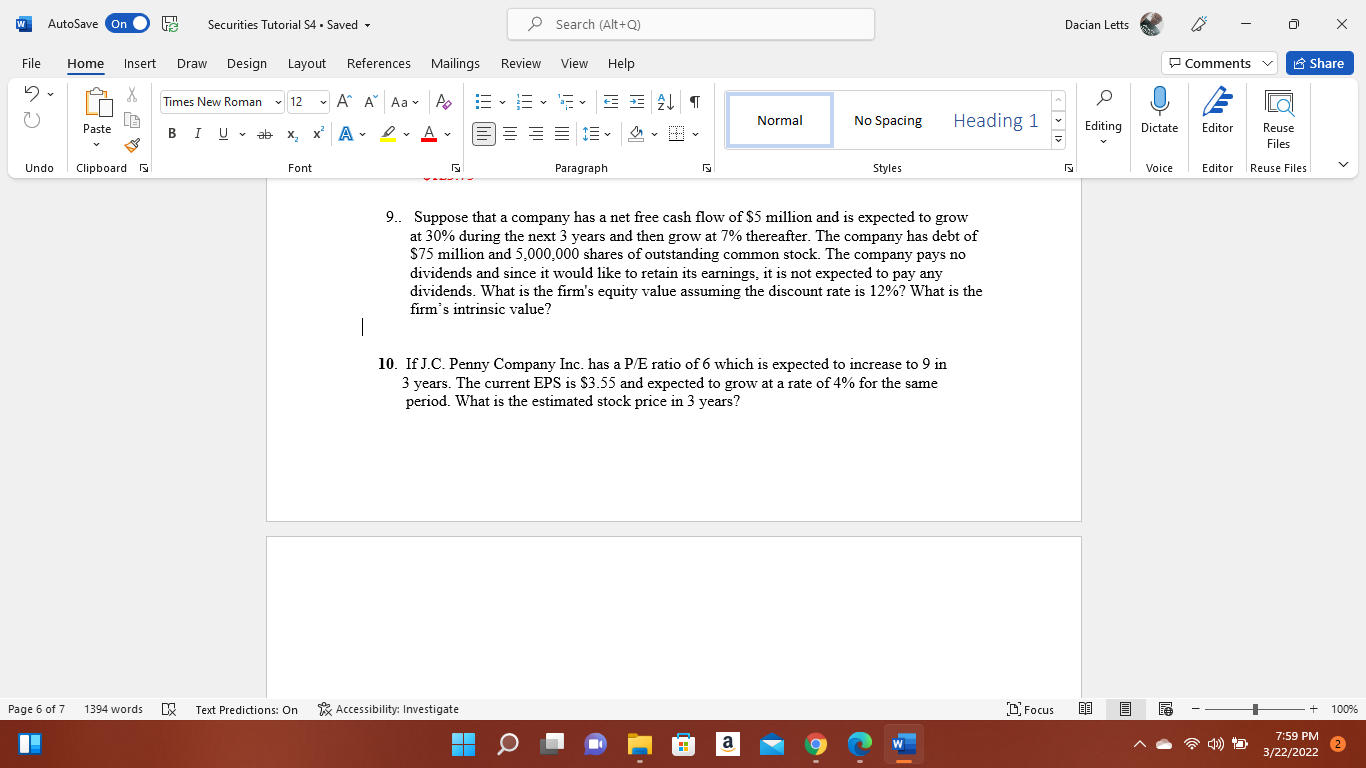

W w AutoSave On Securities Tutorial S4 . Saved Search (Alt+Q) Dacian Letts File Home Insert Draw Design Layout References Mailings Review View Help Comments Share X Times New Roman 12 A A Aa A Ev E ALT BI UB X, X A ? A v a o Editing Dictate Normal No Spacing Heading 1 La Reuse Files Paste Editor v y Undo Clipboard Font Paragraph Styles Voice Editor Reuse Files 9. Suppose that a company has a net free cash flow of $5 million and is expected to grow at 30% during the next 3 years and then grow at 7% thereafter. The company has debt of $75 million and 5,000,000 shares of outstanding common stock. The company pays no dividends and since it would like to retain its earnings, it is not expected to pay any dividends. What is the firm's equity value assuming the discount rate is 12%? What is the firm's intrinsic value? 10. If J.C. Penny Company Inc. has a P/E ratio of 6 which is expected to increase to 9 in 3 years. The current EPS is $3.55 and expected to grow at a rate of 4% for the same period. What is the estimated stock price in 3 years? Page 6 of 7 1394 words DX Text Predictions: On Accessibility: Investigate C Focus + 100% a W 7:59 PM 3/22/2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts