Question: (W11) please help! thank you so much!! w.com/um/takeAssignment/takeAssignmentMain.do?invoker &takeAssignmentSessionLocator &inprogress=false Sign in eBook Print Item Present Value of an Annuity Determine the present value of

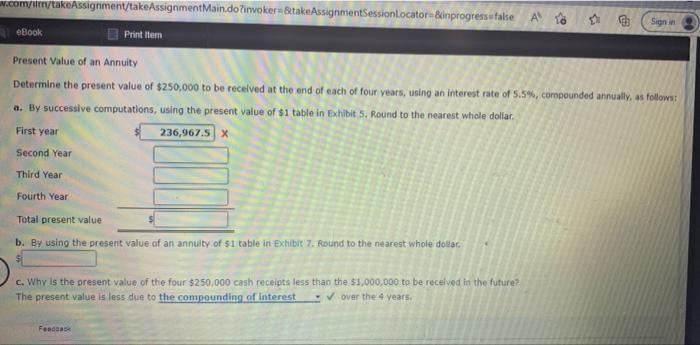

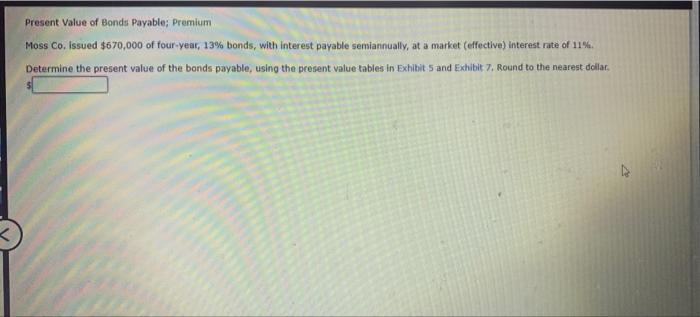

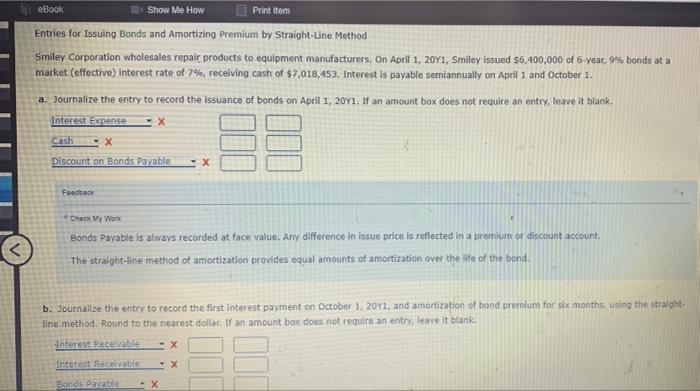

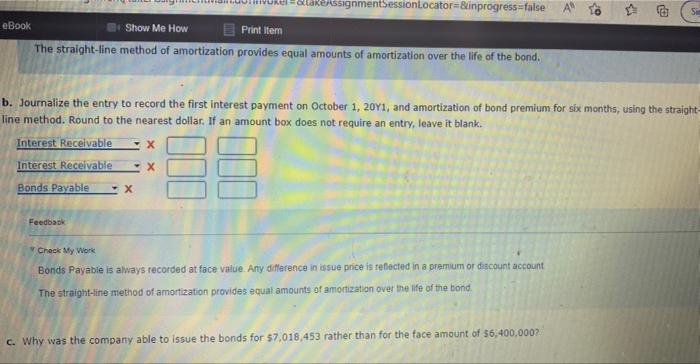

w.com/um/takeAssignment/takeAssignmentMain.do?invoker &takeAssignmentSessionLocator &inprogress=false Sign in eBook Print Item Present Value of an Annuity Determine the present value of $250,000 to be received at the end of each of four years, using an interest rate of 5.5%, compounded annually, as follows: a. By successive computations, using the present value of $1 table in Exhibit 5. Round to the nearest whole dollar. First year 236,967.5 X Second Year Third Year Fourth Year Total present value b. By using the present value of an annuity of $1 table in Exhibit 7. Round to the nearest whole dollar. c. Why is the present value of the four $250,000 cash receipts less than the $1,000,000 to be received in the future? The present value is less due to the compounding of interest over the 4 years. Feedback Present Value of Bonds Payable; Premium Moss Co. Issued $670,000 of four-year, 13% bonds, with interest payable semiannually, at a market (effective) interest rate of 11%. Determine the present value of the bonds payable, using the present value tables in Exhibit 5 and Exhibit 7. Round to the nearest dollar. eBook Show Me How Print Item Entries for Issuing Bonds and Amortizing Premium by Straight-Line Method Smiley Corporation wholesales repair products to equipment manufacturers. On April 1, 2011, Smiley issued $6,400,000 of 6-year, 9% bonds at a market (effective) interest rate of 7%, receiving cash of $7,018,453. Interest is payable semiannually on April 1 and October 1. a. Journalize the entry to record the issuance of bonds on April 1, 2011. If an amount box does not require an entry, leave it blank. Interest Expense Cash -X Discount on Bonds Payable -X Feedback Check My Work Bonds Payable is always recorded at face value. Any difference in issue price is reflected in a premium or discount account. The straight-line method of amortization provides equal amounts of amortization over the life of the bond. b. Journalize the entry to record the first interest payment on October 1, 20Y1, and amortization of bond premium for six months, using the straight- line method. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. Interest Receivable -X Interest Receivable Bonds Payable X X &lakeAssignmentSessionLocator &inprogress-false A To Sim eBook Show Me How Print Item The straight-line method of amortization provides equal amounts of amortization over the life of the bond. b. Journalize the entry to record the first interest payment on October 1, 20Y1, and amortization of bond premium for six months, using the straight- line method. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. Interest Receivable Interest Receivable X Bonds Payable -X Feedback Check My Work Bonds Payable is always recorded at face value. Any difference in issue price is reflected in a premium or discount account The straight-line method of amortization provides equal amounts of amortization over the life of the bond. c. Why was the company able to issue the bonds for $7,018,453 rather than for the face amount of $6,400,000? B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts