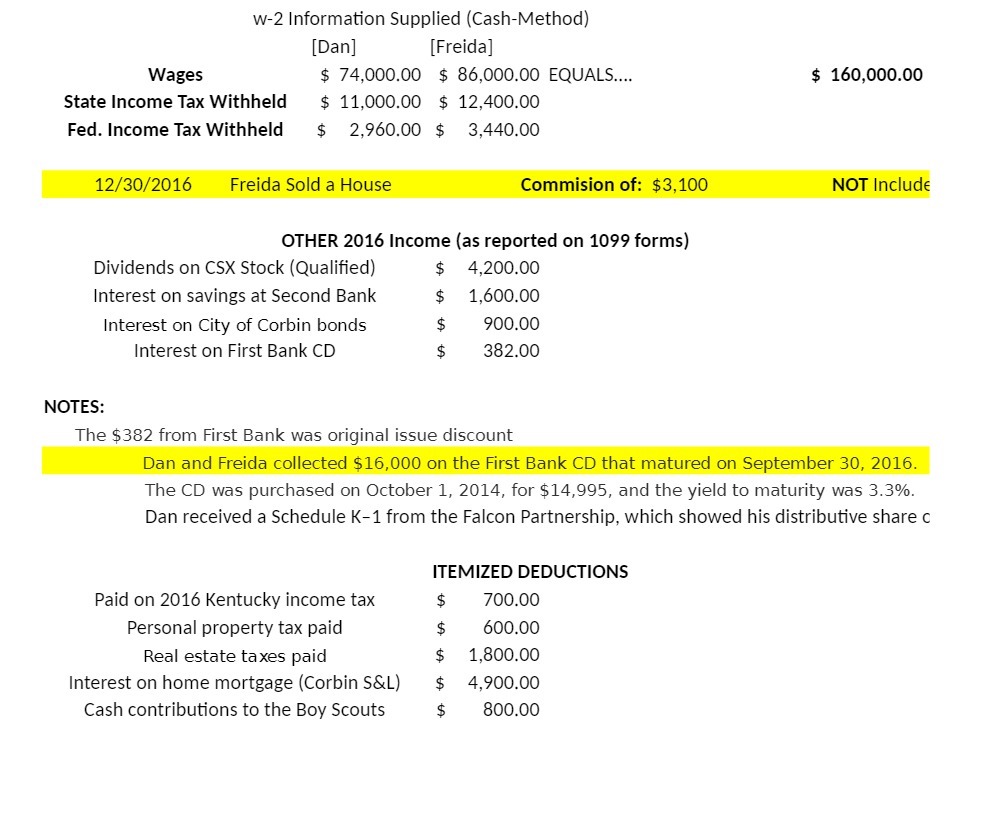

Question: w-2 Information Supplied (Cash-Method) [Dan] [Freida] Wages $ 74,000.00 $ 86,000.00 EQUALS.... $ 160,000.00 State Income Tax Withheld $ 11,000.00 $ 12,400.00 Fed. Income Tax

![w-2 Information Supplied (Cash-Method) [Dan] [Freida] Wages $ 74,000.00 $ 86,000.00](https://s3.amazonaws.com/si.experts.images/answers/2024/06/66783a9a38013_35466783a9a15198.jpg)

w-2 Information Supplied (Cash-Method) [Dan] [Freida] Wages $ 74,000.00 $ 86,000.00 EQUALS.... $ 160,000.00 State Income Tax Withheld $ 11,000.00 $ 12,400.00 Fed. Income Tax Withheld $ 2,960.00 $ 3,440.00 12/30/2016 Freida Sold a House Commision of: $3,100 NOT Include OTHER 2016 Income (as reported on 1099 forms) Dividends on CSX Stock (Qualified) $ 4,200.00 Interest on savings at Second Bank 1,600.00 Interest on City of Corbin bonds 900.00 Interest on First Bank CD LA 382.00 NOTES: The $382 from First Bank was original issue discount Dan and Freida collected $16,000 on the First Bank CD that matured on September 30, 2016. The CD was purchased on October 1, 2014, for $14,995, and the yield to maturity was 3.3%. Dan received a Schedule K-1 from the Falcon Partnership, which showed his distributive share c ITEMIZED DEDUCTIONS Paid on 2016 Kentucky income tax $ 700.00 Personal property tax paid 600.00 Real estate taxes paid 1,800.00 Interest on home mortgage (Corbin S&L) to 4,900.00 Cash contributions to the Boy Scouts $ 800.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts