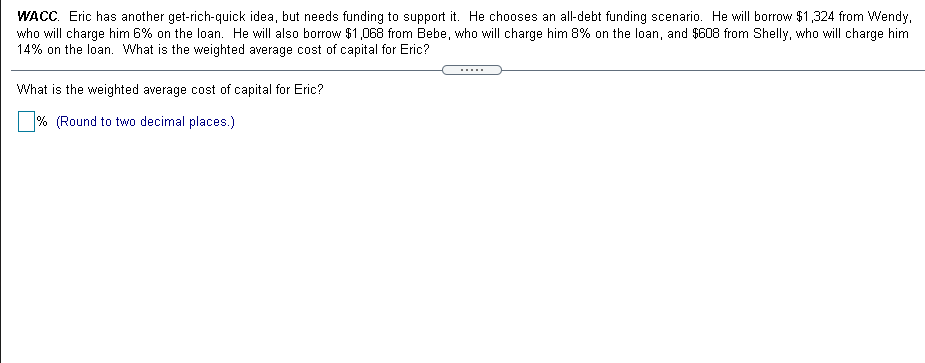

Question: WACC. Eric has another get-rich-quick idea, but needs funding to support it. He chooses an all-debt funding scenario. He will borrow $1,324 from Wendy. who

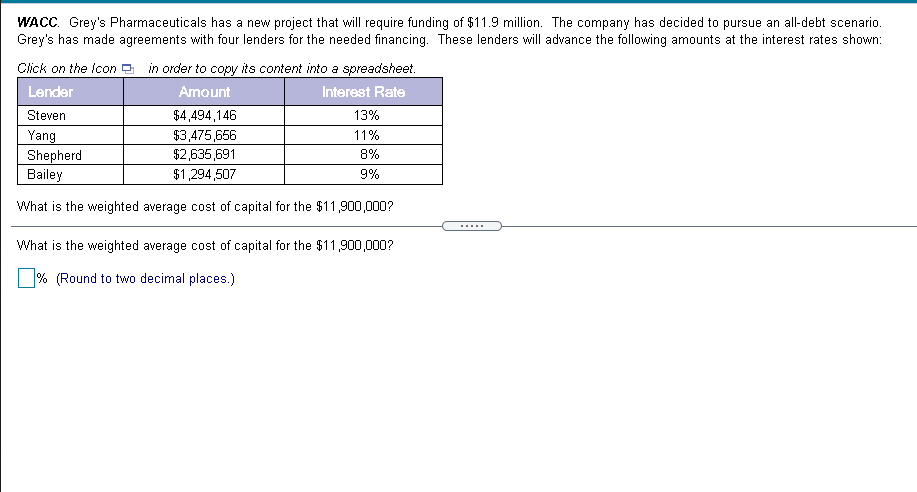

WACC. Eric has another get-rich-quick idea, but needs funding to support it. He chooses an all-debt funding scenario. He will borrow $1,324 from Wendy. who will charge him 6% on the loan. He will also borrow $1,068 from Bebe, who will charge him 8% on the loan, and $608 from Shelly, who will charge him 14% on the loan. What is the weighted average cost of capital for Eric? What is the weighted average cost of capital for Eric? % (Round to two decimal places.) WACC. Grey's Pharmaceuticals has a new project that will require funding of $11.9 million. The company has decided to pursue an all-debt scenario. Grey's has made agreements with four lenders for the needed financing. These lenders will advance the following amounts at the interest rates shown: Click on the icon in order to copy its content into a spreadsheet. Lender Amount Interest Rate $4,494,146 13% Yang $3,475,656 11% Shepherd $2,635,691 8% Bailey $1,294,507 9% Steven What is the weighted average cost of capital for the $11,900,000? What is the weighted average cost of capital for the $11,900,000? % (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts