Question: WACC. Eric has another get-rich-quick idea, but needs funding to support it. He chooses an all-debt funding scenario. He will borrow $409 from Wendy, who

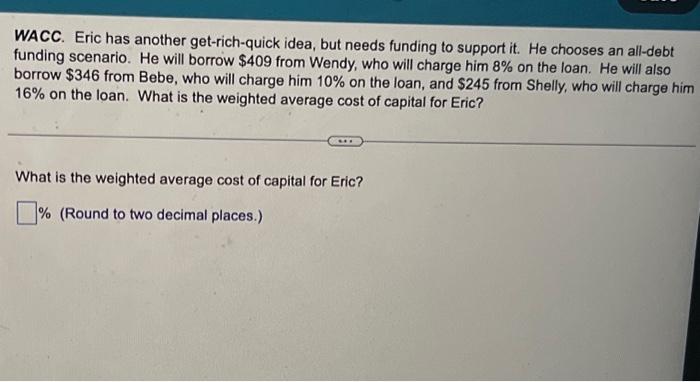

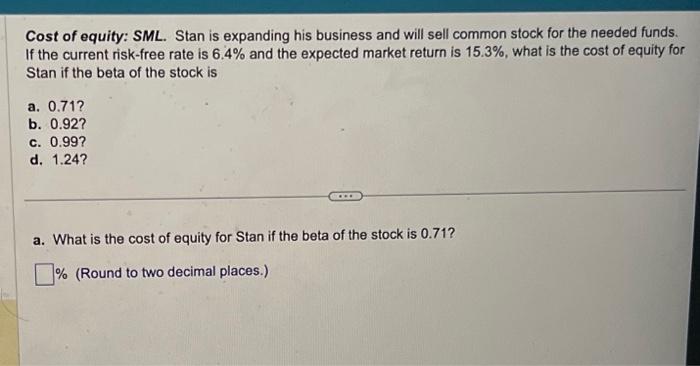

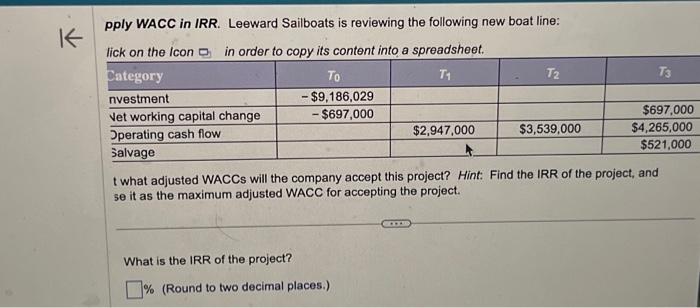

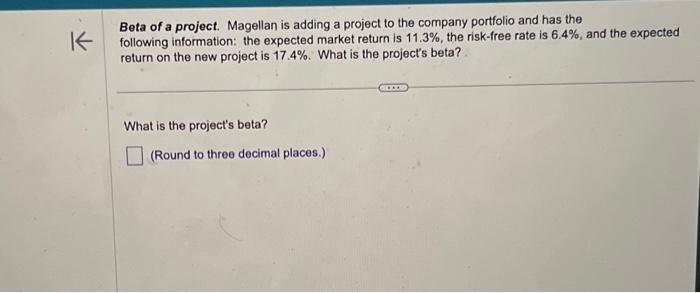

WACC. Eric has another get-rich-quick idea, but needs funding to support it. He chooses an all-debt funding scenario. He will borrow $409 from Wendy, who will charge him 8% on the loan. He will also borrow $346 from Bebe, who will charge him 10% on the loan, and \$245 from Shelly, who will charge him 16% on the loan. What is the weighted average cost of capital for Eric? What is the weighted average cost of capital for Eric? % (Round to two decimal places.) Cost of equity: SML. Stan is expanding his business and will sell common stock for the needed funds. If the current risk-free rate is 6.4% and the expected market return is 15.3%, what is the cost of equity for Stan if the beta of the stock is a. 0.71 ? b. 0.92 ? c. 0.99 ? d. 1.24 ? a. What is the cost of equity for Stan if the beta of the stock is 0.71 ? % (Round to two decimal places.) pply WACC in IRR. Leeward Sailboats is reviewing the following new boat line: lick on the Icon in order to copy its content into a spreadsheet. t what adjusted WACCs will the company accept this project? Hint: Find the IRR of the project, and se it as the maximum adjusted WACC for accepting the project. What is the IRR of the project? \% (Round to two decimal places.) Beta of a project. Magellan is adding a project to the company portfolio and has the following information: the expected market return is 11.3%, the risk-free rate is 6.4%, and the expected return on the new project is 17.4%. What is the project's beta? What is the project's beta? (Round to three decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts