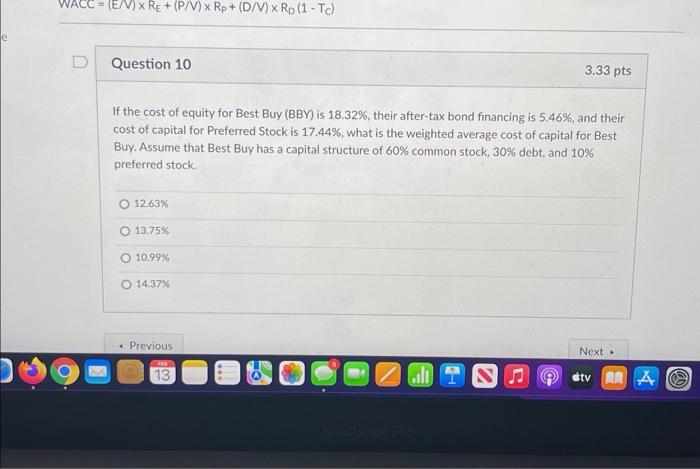

Question: WACC = (E/V)x Re + (P/V) x Rp+ (D/V) x Rp (1-T) le Question 10 3.33 pts If the cost of equity for Best Buy

WACC = (E/V)x Re + (P/V) x Rp+ (D/V) x Rp (1-T) le Question 10 3.33 pts If the cost of equity for Best Buy (BBY) is 18.32%, their after-tax bond financing is 5.46%, and their cost of capital for Preferred Stock is 17.44%, what is the weighted average cost of capital for Best Buy. Assume that Best Buy has a capital structure of 60% common stock, 30% debt, and 10% preferred stock O 12.63% O 13.75% 10.99% O 1437% Previous Next 13 ili 1 etv RA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts