Question: WACC METHOD FINANCE QUESTION You have been employed by a company called Plastitubes Led., as a project-finance manager, working with a small team of project-finance

WACC METHOD FINANCE QUESTION

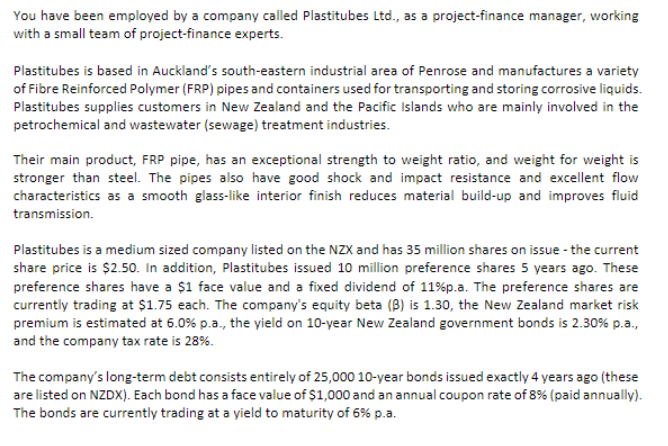

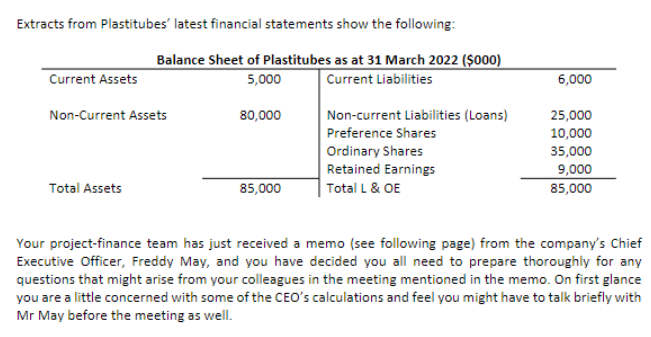

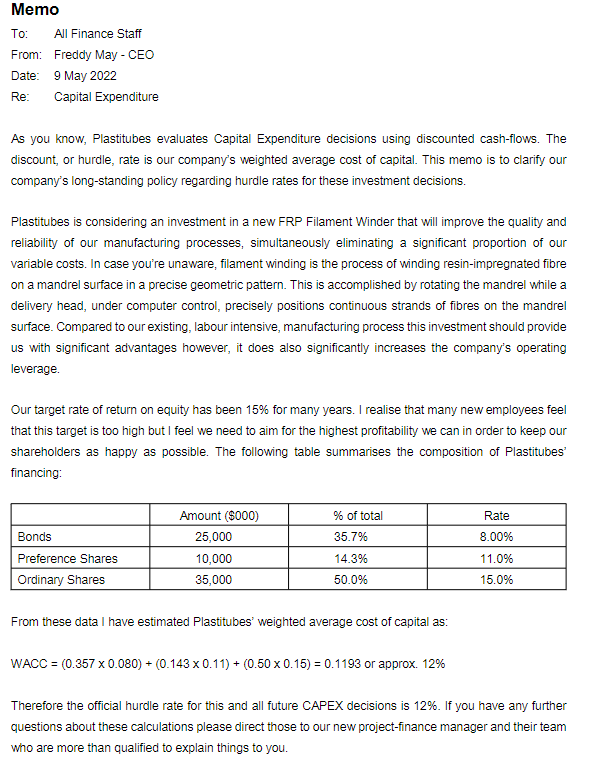

You have been employed by a company called Plastitubes Led., as a project-finance manager, working with a small team of project-finance experts. Plastitubes is based in Auckland's south-eastern industrial area of Penrose and manufactures a variety of Fibre Reinforced Polymer (FRP) pipes and containers used for transporting and storing corrosive liquids. Plastitubes supplies customers in New Zealand and the Pacific Islands who are mainly involved in the petrochemical and wastewater (sewage) treatment industries. Their main product, FRP pipe, has an exceptional strength to weight ratio, and weight for weight is stronger than steel. The pipes also have good shock and impact resistance and excellent flow characteristics as a smooth glass-like interior finish reduces material build-up and improves fluid transmission. Plastitubes is a medium sized company listed on the NZX and has 35 million shares on issue - the current share price is $2.50. In addition, Plastitubes issued 10 million preference shares 5 years ago. These preference shares have a $1 face value and a fixed dividend of 11%p.a. The preference shares are currently trading at $1.75 each. The company's equity beta (B) is 1.30, the New Zealand market risk premium is estimated at 6.0% p.a., the yield on 10-year New Zealand government bonds is 2.30% p.a., and the company tax rate is 28%. The company's long-term debt consists entirely of 25,000 10-year bonds issued exactly 4 years ago (these are listed on NZDX). Each bond has a face value of $1,000 and an annual coupon rate of 8% (paid annually). The bonds are currently trading at a yield to maturity of 6% p.a.Extracts from Plastitubes' latest financial statements show the following: Balance Sheet of Plastitubes as at 31 March 2022 ($000) Current Assets 5,000 Current Liabilities 6,000 Non-Current Assets 80,000 Non-current Liabilities (Loans) 25,000 Preference Shares 10,000 Ordinary Shares 35,000 Retained Earnings 9,000 Total Assets 85,000 Total L & OE 85,000 Your project-finance team has just received a memo (see following page) from the company's Chief Executive Officer, Freddy May, and you have decided you all need to prepare thoroughly for any questions that might arise from your colleagues in the meeting mentioned in the memo. On first glance you are a little concerned with some of the CEO's calculations and feel you might have to talk briefly with Mr May before the meeting as well.Memo To: All Finance Staff From: Freddy May - CEO Date: 9 May 2022 Re: Capital Expenditure As you know, Plastitubes evaluates Capital Expenditure decisions using discounted cash-flows. The discount, or hurdle, rate is our company's weighted average cost of capital. This memo is to clarify our company's long-standing policy regarding hurdle rates for these investment decisions. Plastitubes is considering an investment in a new FRP Filament Winder that will improve the quality and reliability of our manufacturing processes, simultaneously eliminating a significant proportion of our variable costs. In case you're unaware, filament winding is the process of winding resin-impregnated fibre on a mandrel surface in a precise geometric pattern. This is accomplished by rotating the mandrel while a delivery head, under computer control, precisely positions continuous strands of fibres on the mandrel surface. Compared to our existing, labour intensive, manufacturing process this investment should provide us with significant advantages however, it does also significantly increases the company's operating leverage. Our target rate of return on equity has been 15% for many years. I realise that many new employees feel that this target is too high but I feel we need to aim for the highest profitability we can in order to keep our shareholders as happy as possible. The following table summarises the composition of Plastitubes' financing: Amount ($000) % of total Rate Bonds 25,000 35.7% 8.00% Preference Shares 10,000 14.3% 11.0% Ordinary Shares 35,000 50.0% 15.0% From these data I have estimated Plastitubes' weighted average cost of capital as: WACC = (0.357 x 0.080) + (0.143 x 0.11) + (0.50 x 0.15) = 0.1193 or approx. 12% Therefore the official hurdle rate for this and all future CAPEX decisions is 12%. If you have any further questions about these calculations please direct those to our new project-finance manager and their team who are more than qualified to explain things to you

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts