Question: WACC Practice Problem a) The levered beta and the debt equity ratio of other firms, the higher the debt equity ratio, the lower the levered

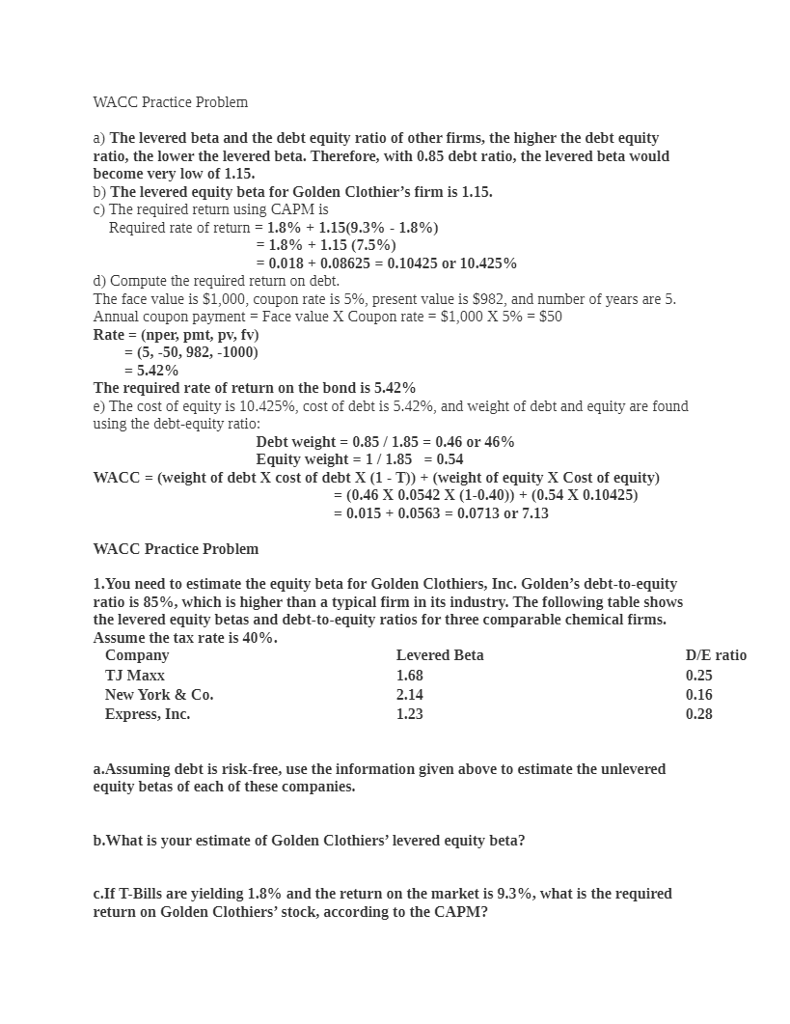

WACC Practice Problem a) The levered beta and the debt equity ratio of other firms, the higher the debt equity ratio, the lower the levered beta. Therefore, with 0.85 debt ratio, the levered beta would become very low of 1.15 b) The levered equity beta for Golden Clothier's firm is 1.15. C) The required return using CAPM is Required rate of return-1.8% + 1.15(9.3%-1.8%) -1.8% + 1.15 (7.5%) 0.018 + 0.08625-0.10425 or 10.425% d) Compute the required return on debt. The face value is $1,000, coupon rate is 5%, present value is $982, and number of years are 5. Annual coupon payment-Face value X Coupon rate = $1,000 X 596-350 Rate (nper, pmt, pv, fv) (5, -50, 982, -1000) 5.42% The required rate of return on the bond is 5.42% e) The cost of equity is 10.425%, cost of debt is 5.42%, and weight of debt and equity are found using the debt-equity ratio Debt weight-0.85 / 1.85-0.46 or 46% Equity weight-1/1.850.54 WACC (weight of debt X cost of debt X (1- T)) + (weight of equity X Cost of equity) = (0.46 X 0.0542 X (1-0.40)) + (0.54 X 0.10425) 0.0150.0563 0.0713 or 7.13 WACC Practice Problem 1.You need to estimate the equity beta for Golden Clothiers, Inc. Golden's debt-to-equity ratio is 85%, which is higher than a typical firm in its industry. The following table shows the levered equity betas and debt-to-equity ratios for three comparable chemical firms. Assume the tax rate is 40%. Company TJ Maxx New York & Co. Express, Inc. Levered Beta 1.68 2.14 1.23 D/E ratio 0.25 0.16 0.28 a.Assuming debt is risk-free, use the information given above to estimate the unlevered equity betas of each of these companies. b.What is your estimate of Golden Clothiers' levered equity beta? c.lf T-Bills are yielding 1.8% and the return on the market is 9.3%, what is the required return on Golden Clothiers' stock, according to the CAPM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts