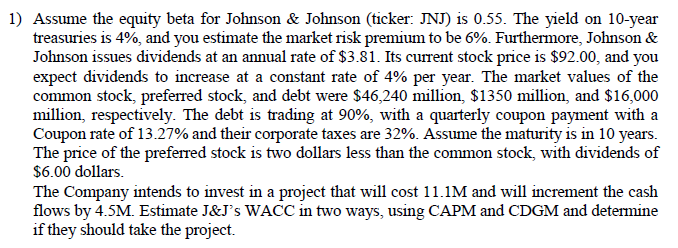

Question: WACC using CAPM? WACC using CDGM? Should project be taken? 1) Assume the equity beta for Johnson & Johnson (ticker: JNJ) is 0.55. The yield

WACC using CAPM?

WACC using CDGM?

Should project be taken?

1) Assume the equity beta for Johnson & Johnson (ticker: JNJ) is 0.55. The yield on 10-year treasuries is 4%, and you estimate the market risk premium to be 6%. Furthermore, Johnson & Johnson issues dividends at an annual rate of $3.81. Its current stock price is $92.00, and you expect dividends to increase at a constant rate of 4% per year. The market values of the common stock, preferred stock, and debt were $46,240 million, $1350 million, and $16,000 million, respectively. The debt is trading at 90%, with a quarterly coupon payment with a Coupon rate of 13.27% and their corporate taxes are 32%. Assume the maturity is in 10 years. The price of the preferred stock is two dollars less than the common stock, with dividends of $6.00 dollars. The Company intends to invest in a project that will cost 11.1M and will increment the cash flows by 4.5M. Estimate J&J's WACC in two ways, using CAPM and CDGM and determine if they should take the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts