Question: Wacks Company uses the direct write-off method to account for uncollectible receivables. On September 18, Wacks wrote of a 56,200 account receivable from customer W.

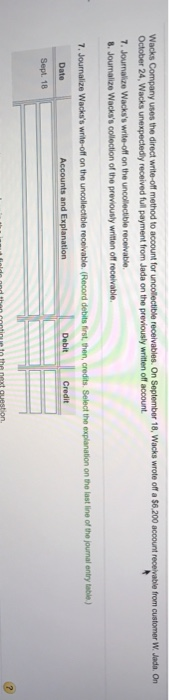

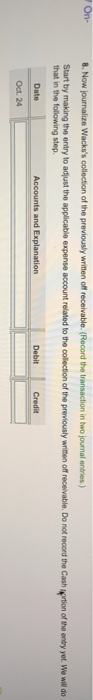

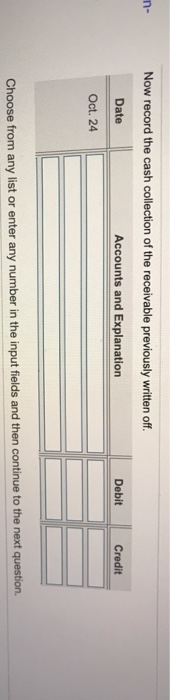

Wacks Company uses the direct write-off method to account for uncollectible receivables. On September 18, Wacks wrote of a 56,200 account receivable from customer W. Jada. On October 24, Wacks unexpectedly received full payment from Jada on the previously written off account 7. Journalize Wacks's write-off on the uncollectible receivable 8. Journalize Wacks's collection of the previously written off receivable, 7. Journalize Wacks's write-off on the uncollectible receivable. (Record debits first, then, credits. Select the explanation on the last line of the journal entry table) Date Accounts and Explanation Debit Credit Sept. 18 7 On- 8. Now journalize Wacko's collection of the previously written off receivable. (Record the transaction in two journal entries.) Start by making the entry to adjust the applicable expense account related to the collection of the previously written off receivable. Do not record the Cash prtion of the entry yot. We will do that in the following step Date Accounts and Explanation Debit Credit Oct 24 n- Now record the cash collection of the receivable previously written off. Date Accounts and Explanation Oct. 24 Debit Credit Choose from any list or enter any number in the input fields and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts