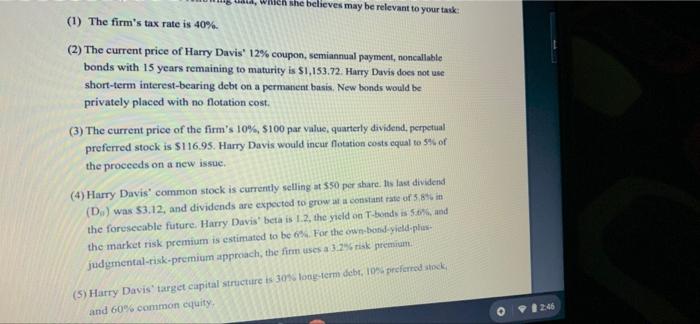

Question: Wald, Will she believes may be relevant to your task (1) The firm's tax rate is 40%. (2) The current price of Harry Davis' 12%

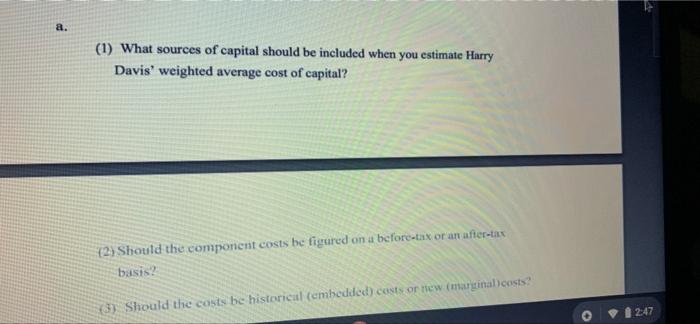

Wald, Will she believes may be relevant to your task (1) The firm's tax rate is 40%. (2) The current price of Harry Davis' 12% coupon, semiannual payment, noncallable bonds with 15 years remaining to maturity is $1,153.72. Harry Duvis does not use short-term interest-bearing debt on a permanent basis. New bonds would be privately placed with no flotation cost. (3) The current price of the firm's 10%, 5100 par value, quarterly dividend, perpetual preferred stock is $116.95. Harry Davis would incur flotation costs equal to 5% of the proceeds on a new issue (4) Harry Davis' common stock is currently selling at 550 per share. Iis faut dividend (D) was 53.12, and dividends are expected to grow at a constant rate of 58o in the foreseeable future. Harry Davis' beta is 1.2, the yield on T-bonds is 50% and the market risk premium is estimated to be 6%. For the own-bond-yield-phus judgmental-risk-premium approach, the firm uses a 3.2%tisk premium. (5) Harry Davis' target capital structure is 30% long-term dehr, 10 preferred stock, and 60% common equity o 2:06 a. (1) What sources of capital should be included when you estimate Harry Davis' weighted average cost of capital? 12Should the component costs be figured on a before-tex or an after-tax basis? (3) Should the costs be historical (embedded) costs or new marginal costs 12:47

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts