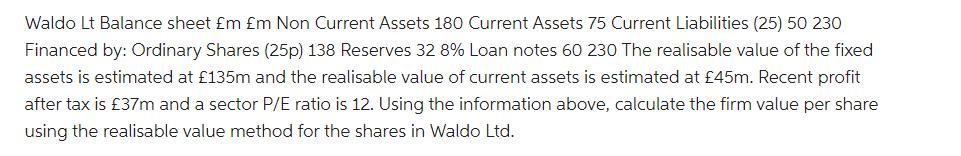

Question: Waldo Lt Balance sheet m m Non Current Assets 180 Current Assets 75 Current Liabilities (25) 50 230 Financed by: Ordinary Shares (25p) 138

Waldo Lt Balance sheet m m Non Current Assets 180 Current Assets 75 Current Liabilities (25) 50 230 Financed by: Ordinary Shares (25p) 138 Reserves 32 8% Loan notes 60 230 The realisable value of the fixed assets is estimated at 135m and the realisable value of current assets is estimated at 45m. Recent profit after tax is 37m and a sector P/E ratio is 12. Using the information above, calculate the firm value per share using the realisable value method for the shares in Waldo Ltd.

Step by Step Solution

3.49 Rating (156 Votes )

There are 3 Steps involved in it

To calculate the firm value per share using the realisable value method we need to determine the tot... View full answer

Get step-by-step solutions from verified subject matter experts