Question: walistreetprep.com / wip _ exam / def - modeling - txam - v 2 fcourse _ jde 3 5 0 7 9 Niew Chrome mailuble

walistreetprep.comwipexamdefmodelingtxamvfcoursejde

Niew Chrome mailuble

Wallstreet Prop

Back to Courte

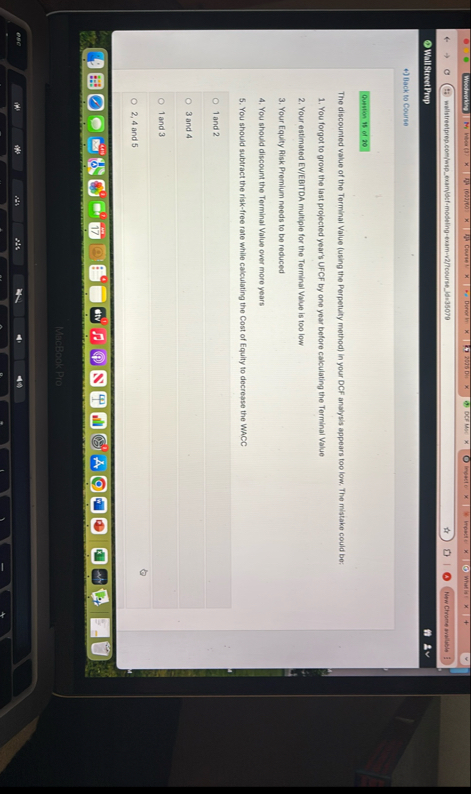

The discounted value of the Terminal Value using the Perpetuity method in your DCF analysis appears too low. The mistake could be:

You forgot to grow the last projected year's UFCF by one year before calculating the Terminal Value

Your estimated EVEBITDA multiple for the Terminal Value is too low

Your Equity Risk Premium needs to be reduced

You should discount the Terminal Value over more years

You should subtract the riskfree rate while calculating the Cost of Equity to decrease the WACC

and

and

and

and

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock