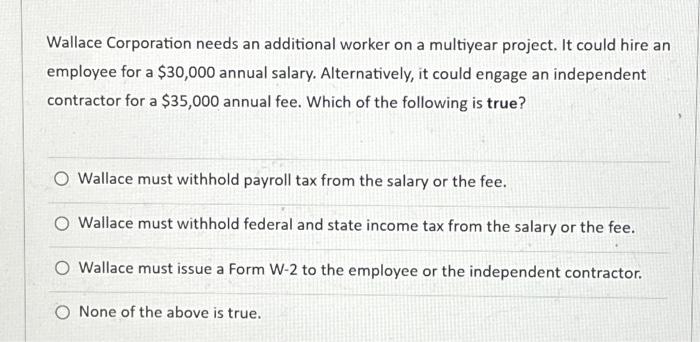

Question: Wallace Corporation needs an additional worker on a multiyear project. It could hire an employee for a $30,000 annual salary. Alternatively, it could engage an

Wallace Corporation needs an additional worker on a multiyear project. It could hire an employee for a $30,000 annual salary. Alternatively, it could engage an independent contractor for a $35,000 annual fee. Which of the following is true? Wallace must withhold payroll tax from the salary or the fee. Wallace must withhold federal and state income tax from the salary or the fee. Wallace must issue a Form W-2 to the employee or the independent contractor. None of the above is true. Wallace Corporation needs an additional worker on a multiyear project. It could hire an employee for a $30,000 annual salary. Alternatively, it could engage an independent contractor for a $35,000 annual fee. Which of the following is true? Wallace must withhold payroll tax from the salary or the fee. Wallace must withhold federal and state income tax from the salary or the fee. Wallace must issue a Form W-2 to the employee or the independent contractor. None of the above is true

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts