Question: Walt is a new tax preparer. A potential client called Walt to ask for advice about filing an injured spouse allocation. Walt provided the information

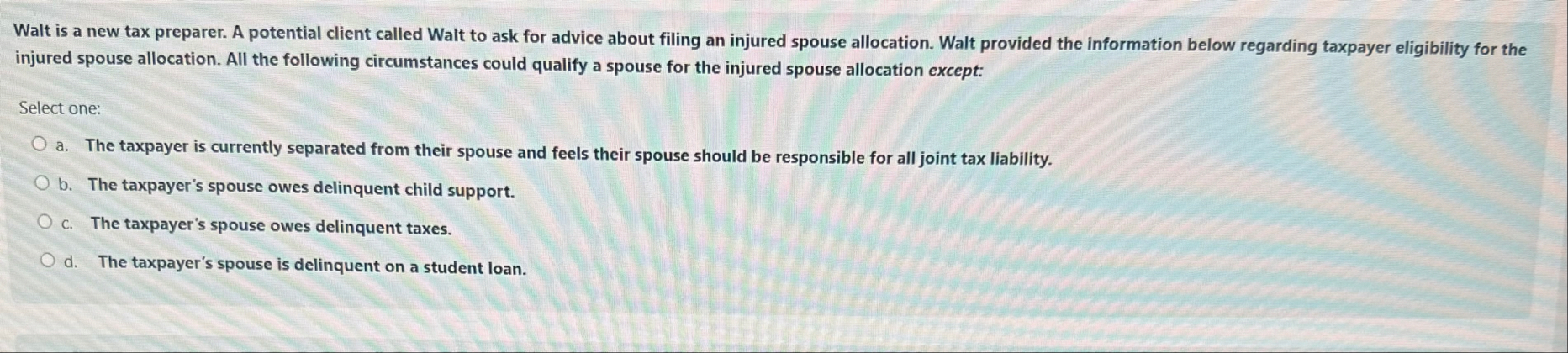

Walt is a new tax preparer. A potential client called Walt to ask for advice about filing an injured spouse allocation. Walt provided the information below regarding taxpayer eligibility for the injured spouse allocation. All the following circumstances could qualify a spouse for the injured spouse allocation except:

Select one:

a The taxpayer is currently separated from their spouse and feels their spouse should be responsible for all joint tax liability.

b The taxpayer's spouse owes delinquent child support.

c The taxpayer's spouse owes delinquent taxes.

d The taxpayer's spouse is delinquent on a student loan.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock